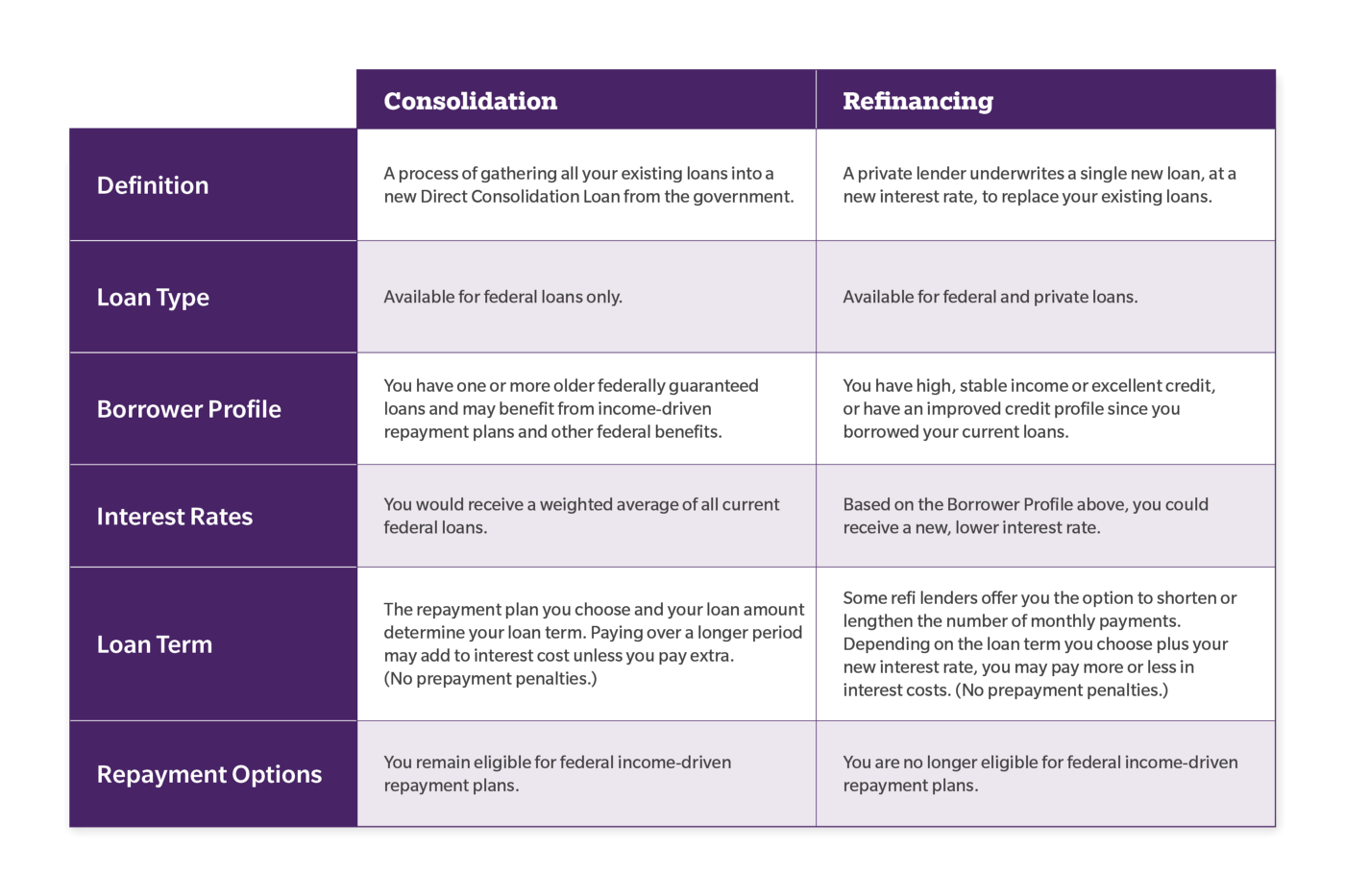

It is important to think smartly about how you can save money while paying off your debt. Other than getting the best mortgage or credit card, there are other ways you can maximize your savings. One is to get a debt consolidation loan at a low interest rate. This will leave you with just one payment to worry about, and you might even get a better interest rate if your financial situation improves.

It is difficult to save while paying down debt. However, it's not impossible. With some smart financial planning, you can save your hard earned cash without sacrificing your quality of life. The benefits of smart financial planning may surprise you.

A budget is the best way to start. A budget is a good way to track your spending habits and keep your frugality in check. Once you have sorted your monthly expenses, start to save some money. Make sure to set up an emergency savings fund, as well.

You should save money to pay off your debts and not to just make a nice amount of cash. Remember to keep your credit limit in sight. Even though you may be tempted, don't forget to limit your credit limit. Your lender should send you a statement every other month with the current rate.

While paying off your debts is an admirable goal, don't do it all. You may be wasting time and energy on the process, and you can also put your efforts into other more productive pursuits. It's time to take a hard look at what you spend money on and reduce the unnecessary. If you aren't disciplined, you will find yourself in debt much sooner than you realize.

For the most part, the biggest saving isn't to be found in the bank. Instead, pay off your loans as soon as you can. By doing so, you will be able to reduce the amount you spend on interest and save money for other things. If you cannot afford to pay your loans off, your lender might impose a severe penalty.

Savings accounts are not something you can afford. But you should aim for at least 10% of your monthly gross income to go into savings. In the best case scenario, this amount will turn into a nice nest-egg for your retirement.

Smart financial planning coupled with discipline is the best way of saving money while paying off your debt. Even though it may seem tempting to put all your savings towards your debts. It is best to save your credit limit, and then use the savings to cover any emergency. Once your debts are paid off, you can start investing. Doing so could help you reach higher heights in the long-term.

There are many options for financial assistance. You might prefer a traditional bank, but there are alternative lenders that can offer consolidation loans.

FAQ

Why is personal finance important?

Anyone who is serious about financial success must be able to manage their finances. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why should we save money when there are better things? Is it not better to use our time or energy on something else?

Both yes and no. Yes, as most people feel guilty about saving their money. Yes, but the more you make, the more you can invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

It is important to learn how to control your emotions if you want to become financially successful. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Unrealistic expectations may also be a factor in how much you will end up with. This could be because you don't know how your finances should be managed.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

Which side hustles are most lucrative?

Side hustles are income streams that add to your primary source of income.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles are smart and can fit into your life. You might consider starting your own fitness business if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles are available anywhere. Side hustles can be found anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you are a skilled writer, why not open your own graphic design studio?

Be sure to research thoroughly before you start any side hustle. You'll be ready to grab the opportunity when it presents itself.

Side hustles are not just about making money. They can help you build wealth and create freedom.

There are so many ways to make money these days, it's hard to not start one.

How does rich people make passive income from their wealth?

There are two methods to make money online. One way is to produce great products (or services) for which people love and pay. This is called "earning” money.

A second option is to find a way of providing value to others without creating products. This is called passive income.

Let's say you own an app company. Your job involves developing apps. You decide to make them available for free, instead of selling them to users. This business model is great because it does not depend on paying users. Instead, you rely upon advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is the way that most internet entrepreneurs are able to make a living. Instead of making money, they are focused on providing value to others.

How much debt are you allowed to take on?

There is no such thing as too much cash. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. Even after years of saving, this will ensure you won't go broke.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. If you make $20,000, you should' t spend more than $2,000 per month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

It is important to get rid of debts as soon as possible. This includes student loans, credit card debts, car payments, and credit card bill. When these are paid off you'll have money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. You can still expect interest to accrue if your money is saved.

Let's take, for example, $100 per week that you have set aside to save. It would add up towards $500 over five-years. In six years you'd have $1000 saved. You'd have almost $3,000 in savings by the end of eight years. It would take you close to $13,000 to save by the time that you reach ten.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's pretty impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. You'd have more than $57,000 instead of $40,000

That's why it's important to learn how to manage your finances wisely. If you don't do this, you may end up spending far more than you originally planned.

Which side hustles are the most lucrative in 2022

To create value for another person is the best way to make today's money. If you do this well the money will follow.

Although you may not be aware of it, you have been creating value from day one. When you were little, you took your mommy's breastmilk and it gave you life. Your life will be better if you learn to walk.

You'll continue to make more if you give back to the people around you. You'll actually get more if you give more.

Everyone uses value creation every day, even though they don't know it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In reality, Earth has nearly 7 Billion people. Each person creates an incredible amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. You would earn far more than you are currently earning working full-time.

Let's imagine you wanted to make that number double. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day offers millions of opportunities to add value. This includes selling ideas, products, or information.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. Helping others achieve theirs is the real goal.

Create value to make it easier for yourself and others. Use my guide How to create value and get paid for it.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You don't need to worry about monthly rent and utility bills.

Not only will it help you to get ahead, but also how to manage your money. It makes you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finance anyway? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People now use smartphones to track their money, compare prices and create wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. Only two hours are left each day to do the rest of what is important.

Financial management will allow you to make the most of your financial knowledge.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

You can increase cash flow by using passive income ideas

It is possible to make money online with no hard work. Instead, you can make passive income at home.

Perhaps you have an existing business which could benefit from automation. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

Automating your business is a great way to increase its efficiency. This will enable you to devote more time to growing your business instead of running it.

Outsourcing is a great way of automating tasks. Outsourcing allows for you to focus your efforts on what really matters when running your business. You are effectively outsourcing a task and delegating it.

You can concentrate on the most important aspects of your business and let someone else handle the details. Outsourcing makes it easier to grow your business because you won't have to worry about taking care of the small stuff.

A side hustle is another option. Another way to make extra money is to use your talents and create a product that can be sold online.

Write articles, for example. Your articles can be published on many websites. These sites pay per article and allow you to make extra cash monthly.

You can also consider creating videos. You can upload videos to YouTube and Vimeo via many platforms. When you upload these videos, you'll get traffic to both your website and social networks.

One last way to make money is to invest in stocks and shares. Investing stocks and shares is similar investment to real estate. You are instead paid rent. Instead, you receive dividends.

These shares are part of your dividend when you purchase shares. The amount of the dividend depends on how much stock you buy.

You can reinvest your profits in buying more shares if you decide to sell your shares. You will keep receiving dividends for as long as you live.