There are a variety of medical bill consolidation options. These options include in-house financing and debt negotiation, as well as unsecured personal loans. To help you choose the right option for you, learn more about each. To avoid future medical expenses, you should first create a savings account. This will avoid you adding to your current debt.

In-house financing can be a great option for consolidating your medical bills

A personal loan, a home equity loan or balance credit card may be an option if you are struggling to pay your medical bills. A debt management program can be enrolled and your providers will work together to devise a payment plan. Most hospitals and medical professionals will assist you with financial problems. To work out a payment schedule with your providers, it is important that you contact them as soon as possible. If you wait, you might find that the overall cost has increased.

Although medical debt consolidation can be a great choice for those who have medical debt, it is not the best option for everyone. It can help you reduce monthly payments and save money but could ultimately end up hurting credit. You should also consider other options before you make this decision.

Personal loan that is not secured

An unsecured personal loan can be an option if you have financial problems due to medical bills. These loans are usually available through banks and credit unions as well as online lenders. These loans come with varying interest rates, and repayment terms vary from two to ten years. This type of loan is worth considering. Make sure you shop around to find the best rate.

Secured credit is another option to pay your medical bills. These loans generally have lower interest rates compared to unsecured loans. However you must make sure that you can repay the money in a given time. A default on your credit report can lead to an unsecured loan, which can affect your credit score.

Debt negotiation

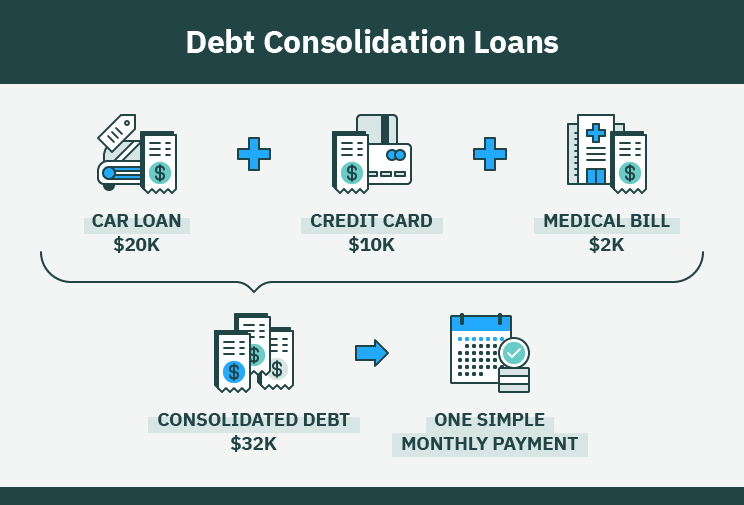

If you are struggling with medical bills, debt negotiation for medical bill consolidation may be an option. Although it's not an easy task, a competent debt negotiator may be able to help you obtain a lower interest and monthly payments as well as debt elimination. You may also be eligible for debt consolidation loans. This will combine all of your existing debts into a single loan that you can pay back over time.

Negotiating with creditors is part of the process of debt negotiation to consolidate medical bills. You must meet specific qualifications. You must be capable of proving that you are facing financial hardship. The second requirement is that you are able to defer a portion your other bills into an account. You might be out of luck if this money is not available.

Bankruptcy

Consolidating medical bill debt is a method to eliminate medical debt and avoid bankruptcy. This service is offered by banks, credit unions, online lenders, and other financial institutions to clients who are looking for a financial solution to their problems with medical bills. The medical bill consolidation loan is an unsecure personal loan. Lenders cannot use your home as collateral. Consumers may prefer this option as they might not be able pay the full amount due without a mortgage.

The Chapter 7 bankruptcy and Chapter 13 forms for medical bill consolidation bankruptcy are both available. The first lets you combine medical bills and other unsecure debt into one payment. In either case, the bankruptcy court sets a repayment plan that is based on your income, expenses, and non-exempt assets. Additional relief options are available for senior citizens and veterans as well as people in recovery.

Non-profit credit counseling

Medical bill consolidation can be a good option to consolidate debt. This consolidation of debt can reduce interest rates on credit card bills. A non-profit credit counseling agency will help you establish a debt management plan which will allow for you to combine your credit card and medical debt.

Although many counseling services can be provided for no cost, others may charge a nominal fee. Before signing up for a program, you should know the details. If the service isn't free, you should read about the costs and whether or not it will work for your needs.

FAQ

What is the limit of debt?

There is no such thing as too much cash. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. If you are running out of funds, cut back on your spending.

But how much is too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. You won't run out of money even after years spent saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

It is important to get rid of debts as soon as possible. This includes student loans, credit card debts, car payments, and credit card bill. After these debts are paid, you will have more money to save.

You should also consider whether you would like to invest any surplus income. You could lose your money if you invest in stocks or bonds. But if you choose to put it into a savings account, you can expect interest to compound over time.

As an example, suppose you save $100 each week. It would add up towards $500 over five-years. After six years, you would have $1,000 saved. You would have $3,000 in your bank account within eight years. In ten years you would have $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. Now that's quite impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. If you don't do this, you may end up spending far more than you originally planned.

How can rich people earn passive income?

There are two methods to make money online. One is to create great products/services that people love. This is what we call "earning money".

A second option is to find a way of providing value to others without creating products. This is called passive income.

Let's assume you are the CEO of an app company. Your job involves developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. Because you don't rely on paying customers, this is a great business model. Instead, you rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how the most successful internet entrepreneurs make money today. They are more focused on providing value than creating stuff.

What is personal financing?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You won't have to worry about paying rent, utilities or other bills each month.

Not only will it help you to get ahead, but also how to manage your money. It makes you happier overall. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

What does personal finance matter to you? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

People now use smartphones to track their money, compare prices and create wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. It leaves just two hours each day to do everything else important.

When you master personal finance, you'll be able to take advantage of that time.

Which passive income is easiest?

There are many ways to make money online. However, most of these require more effort and time than you might think. How do you find a way to earn more money?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is affiliate marketing. There are lots of resources that will help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You could also consider starting a blog as another form of passive income. You'll need to choose a topic that you are passionate about teaching. After you've created your website, you can start offering ebooks and courses to make money.

While there are many methods to make money online there are some that are more effective than others. You can make money online by building websites and blogs that offer useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is called content marketing, and it's a great method to drive traffic to your website.

What side hustles make the most profit?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles are smart and can fit into your life. Consider starting a business in fitness if your passion is working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

You can find side hustles anywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you are a skilled writer, why not open your own graphic design studio?

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles are not just about making money. They are about creating wealth, and freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

Why is personal finance important?

Anyone who is serious about financial success must be able to manage their finances. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

So why should we wait to save money? Is there anything better to spend our energy and time on?

Yes and no. Yes because most people feel guilty about saving money. No, because the more money you earn, the more opportunities you have to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Controlling your emotions is key to financial success. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

You may also have unrealistic expectations about how much money you will eventually accumulate. You don't know how to properly manage your finances.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

How to Make Money Online

How to make money online today differs greatly from how people made money 10 years ago. It is changing how you invest your money. There are many ways to earn passive income, but most require a lot of upfront investment. Some methods are easier than others. There are a few things to consider before you invest your hard-earned money into any online business.

-

Find out what kind of investor you are. PTC sites are a great way to quickly make money. You get paid to click ads. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Do your research before you sign up for any program. Read through reviews, testimonials, and past performance records. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Do not rush to tackle a huge project. Instead, you should start by building something small. This will help you learn the ropes and determine whether this type of business is right for you. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too soon to start making online money. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All that's required is a good idea as well as some commitment. Now is the time to get started!