Consolidation loans are a method of reducing debt by paying off several smaller loans. It involves identifying each debt obligation and applying for a single loan. Then, the debts are paid off in a fixed payment cycle. You would need two loans for an obligation of Rs 3000000. One loan would be for two years at 12% interest, and the other for ten years at 10% interest.

Consolidating unsecured loans with an unsecured loan is not possible

Although unsecured loans are not secured by collateral, they can still have repercussions if you don't make your payments. You will be charged additional interest fees and late fees for any missed payments. Late payments will appear on your credit reports for seven years. In some cases, your account may be put into collections. Although this may sound like a bad idea it can be a great way to pay off your debt.

The best thing to do if you're facing default on your unsecured loan is to contact the lender directly and explain your financial situation. The lender may be willing to help you repay your debt by reducing the required monthly payment or waiving late or over-the-limit fees. Sometimes, lenders lower the interest rates temporarily. This is a great option for those who need it most.

Unsecured loans require income proof

An unsecured loan requires you to provide proof of income to receive the loan. The lender will look at your income and credit history to determine if you can afford the loan. The interest rate will also be determined by the amount of debt you have compared to your income. You can get a lower interest rate if your credit score is good. If you plan on taking out a larger personal loans, you might need to show proof of your income.

You can use bank statements, pay stubs, or tax returns to prove your income. Some lenders may require additional financial information, such proof of benefits. Make sure to verify with your lender that you have all the information you require.

Unsecured loans can be consolidated with an unsecured loan

Consolidating debt can be done by applying for an unsecured loans, which are more flexible. Online and in-person applications are both possible for unsecured loans. There are many different lenders who offer this type of loan. These include local banks, credit unions, and other lenders. Unsecured loans can be obtained from financial institutions other than banks, such as insurance companies, peer-to–peer lenders, and even credit unions.

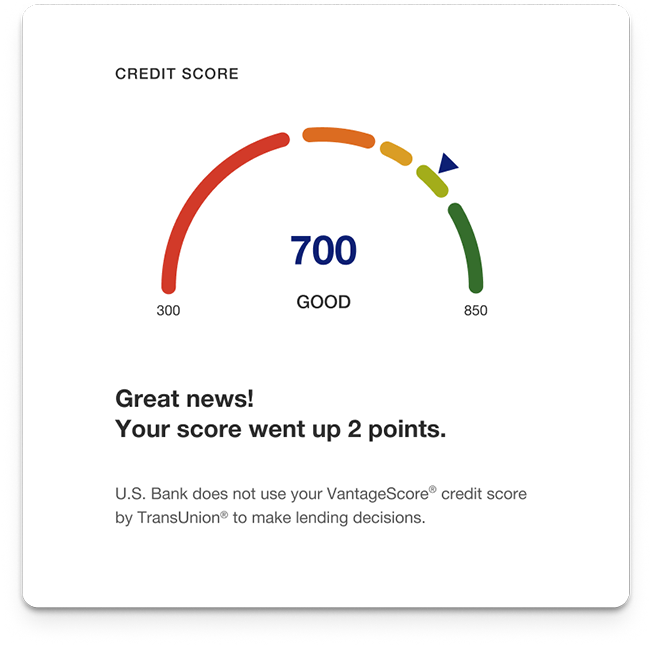

Remember that unsecured loans don't have any collateral. This means your lender won't be able to repossess you assets if the loan defaults. Failure to pay a loan on a timely basis can result in a severe reduction of your credit score, which is often measured using a number called FICO. A low credit score may make it hard to get additional credit. This can lead to foreclosure.

Student loan consolidation

Consolidating multiple student loans into a single loan is called student loan consolidation. This can lead to reduced monthly repayments and longer loan terms. Consolidation loans are available through the Federal Direct Student Loan Program. Consolidating student loans can have many benefits. The process can be very rewarding because it offers lower interest rates, longer terms and fewer monthly payments.

Consolidating your student loans is a great way to get out of the cycle of multiple payments each month. If you have one bill per month, it is easier to manage your finances and keep on top of your payments. Multi-loan debt can make it difficult and easy to miss one payment. Consolidating student loans will help you manage your finances better and ensure you pay on time. Your credit score can be negatively affected by late payments.

Home equity loan consolidation

You can consolidate debts by taking out a home equity mortgage. You will enjoy lower interest rates and lower monthly payments with this type of loan. Before you sign up for this loan you should carefully weigh the advantages and risks. If your circumstances change, your home may be at risk. Consider all your options before taking out a loan to build equity in your home.

A home equity line is another alternative to consolidation of your home equity loan. These loans are revolving lines of credit that allow you to borrow against your home in order to repay your debts. A home equity loan is not like a traditional loan. It has fixed interest rates so you can use it for any purpose. There are other options available for debt consolidation.

FAQ

What is the easiest passive income?

There are tons of ways to make money online. However, most of these require more effort and time than you might think. So how do you create an easy way for yourself to earn extra cash?

The solution is to find what you enjoy, blogging, writing or selling. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

Another option is to start a blog. Once again, you'll need to find a topic you enjoy teaching about. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many ways to make money online, but the best ones are usually the simplest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is called content marketing, and it's a great method to drive traffic to your website.

Which side hustles are most lucrative?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types: active and passive side hustles. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles that are right for you fit in your daily life. A fitness business is a great option if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

You can find side hustles anywhere. You can find side hustles anywhere.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you're an experienced writer so why not go ghostwriting?

Do your research before starting any side-business. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles are not just about making money. They can help you build wealth and create freedom.

There are so many ways to make money these days, it's hard to not start one.

Is there a way to make quick money with a side hustle?

You can't just create a product that solves someone's problem to make quick money if you want to really make it happen.

It is also important to establish yourself as an authority in the niches you choose. It is important to establish a good reputation online as well offline.

The best way to build a reputation is to help others solve problems. Ask yourself how you can be of value to your community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many online ways to make money, but they are often very competitive.

If you are careful, there are two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

There are pros and cons to each approach. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. You will also find fierce competition for these gigs.

Consulting helps you grow your company without worrying about shipping goods or providing service. However, it can take longer to be recognized as an expert in your area.

If you want to succeed at any of the options, you have to learn how identify the right clients. This can take some trial and error. It pays off in the end.

Why is personal finances important?

Personal financial management is an essential skill for anyone who wants to succeed. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why do we put off saving money? Is it not better to use our time or energy on something else?

Yes, and no. Yes because most people feel guilty about saving money. Because the more money you earn the greater the opportunities to invest.

Focusing on the big picture will help you justify spending your money.

To become financially successful, you need to learn to control your emotions. You won't be able to see the positive aspects of your situation and will have no support from others.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you aren't able to manage your finances effectively.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting means putting aside a portion every month for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

How to build a passive stream of income?

To consistently earn from one source, you need to understand why people buy what is purchased.

This means that you must understand their wants and needs. This requires you to be able connect with people and make sales to them.

The next step is how to convert leads and sales. Finally, you must master customer service so you can retain happy clients.

This is something you may not realize, but every product or service needs a buyer. Knowing who your buyer is will allow you to design your entire company around them.

To become a millionaire it takes a lot. To become a billionaire, it takes more effort. Why? To become a millionaire you must first be a thousandaire.

Then, you will need to become millionaire. The final step is to become a millionaire. It is the same for becoming a billionaire.

How do you become a billionaire. Well, it starts with being a thousandaire. All you need to do to achieve this is to start making money.

But before you can begin earning money, you have to get started. Let's now talk about how you can get started.

What are the most profitable side hustles in 2022?

The best way to make money today is to create value for someone else. This will bring you the most money if done well.

Even though you may not realise it right now, you have been creating value since the beginning. Your mommy gave you life when you were a baby. Your life will be better if you learn to walk.

If you keep giving value to others, you will continue making more. Actually, the more that you give, the greater the rewards.

Without even realizing it, value creation is a powerful force everyone uses every day. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

There are actually nearly 7 billion people living on Earth today. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if your hourly value is $1, you could create $7 million annually.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. Imagine that you'd be earning more than you do now working full time.

Let's say that you wanted double that amount. Let's say that you found 20 ways each month to add $200 to someone else's life. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling information, products and services.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Helping others to achieve their goals is the ultimate goal.

To get ahead, you must create value. You can start by using my free guide: How To Create Value And Get Paid For It.

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to Make Money While You Are Asleep

You must be able to fall asleep while you're awake if you want to make it big online. This means learning to do more than wait for someone to click on your link or buy your product. It is possible to make money while you are sleeping.

This requires you to create an automated system that makes money without you having to lift a finger. This requires you to master automation.

You would benefit from becoming an expert at developing software systems that perform tasks automatically. That way, you can focus on making money while you sleep. You can even automate your job.

To find these opportunities, you should create a list with problems that you solve every day. Next, ask yourself if there are any ways you could automate them.

Once you do that, you will probably find that there are many other ways to make passive income. Now, you have to figure out which would be most profitable.

A website builder, for instance, could be developed by a webmaster to automate the creation of websites. If you are a designer, you might be able create templates that automate the creation of logos.

Perhaps you are a business owner and want to develop software that allows multiple clients to be managed at once. There are hundreds of possibilities.

Automation is possible as long your creative ideas solve a problem. Automation is the key for financial freedom.