If you're trying to consolidate debts, a debt consolidation loan calculator will help you calculate your monthly payments. Although it may lower your monthly payments it could also increase your total debt over its term. This type loan may not be the best choice if you must pay off your loans fast.

Home equity loan

Home equity loans allow homeowners to tap into the equity in their homes to help pay off their debts. Each bank will have its own loan-to–value limits. Some banks will allow for 100% of the home’s assessed value. Some banks limit the loan at ninety-percent. You should do your homework to determine the best home equity loan option.

Enter the amount of equity you wish to borrow in order to use a home equity loan calculator. To get an idea of the interest you will pay, you can enter the amount you need and the rate you want to pay. Be sure to add in any property insurance and flood insurance.

Home equity line credit

A home equity credit is a line you use for your debt repayments. These loans have adjustable rates. The interest rate can vary depending on market conditions. The rate you pay on your home equity line of credit can vary based on the amount of your original balance and your monthly income. As needed, you can adjust the amount on your loan or credit line. The product you choose will also affect the amount of your monthly payments. There are three types: fixed-rate and adjustable-rate loans.

If you have several loans, using a home equity line of credit can help you make a more manageable monthly payment. This type loan is a great option to quickly and easily pay off your debts. The calculator will allow you to input the amount of each individual loan and calculate how much you can comfortably afford each month.

Unsecured personal loan

Unsecured personal Loans are loans without collateral. They are generally easier to obtain and less expensive to obtain. These loans can be obtained by people with poor credit. They are also available for people with bad credit. To help them pay their loan, the borrower could include a coborrower. This could be a friend or a family member.

Using a unsecured personal loan calculator will give you an idea of the amount you can borrow, how much you will have to pay each month and how much total repayments will be. It can help you plan your payments.

Secured personal loan

A secured personal loan may be a good option for you if you have high monthly debts and poor credit. These loans usually allow you to combine multiple bills into one payment and can even be approved in a lump amount. Because you only have one monthly payment, this can make it easier to pay off your existing debts quicker. This will also save you money on interest costs.

Once you have entered the current debts, the calculator asks for the amount owed to each account, interest rate, as well as the yearly total. Some of your debts include credit cards, medical bills, and personal loans. But mortgages and auto loans will not be included. This is because they are considered secured loans, and not unsecured debt.

FAQ

How can a beginner generate passive income?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You might have some ideas. If you do, great! However, if not, think about what you can do to add value to the world and how you can put those thoughts into action.

Online earning money is easy if you are looking for opportunities that match your interests and skills.

For example, if you love creating websites and apps, there are plenty of opportunities to help you generate revenue while you sleep.

You might also enjoy reviewing products if you are more interested writing. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. You'll be more likely to stick with it over the long-term.

Once you've identified a product/service which you would enjoy helping others to buy, you will need to determine how to monetize that product or service.

You have two options. The first is to charge a flat-rate for your services (like freelancers) and the second is per project (like agencies).

In each case, once your rates have been set, you will need to promote them. This can be done via social media, emailing, flyers, or posting them to your list.

These are three ways to improve your chances of success in marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. It is impossible to predict who might be reading your content.

-

Be knowledgeable about the topic you are discussing. No one wants to be a fake expert.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. You can send a recommendation to someone who has asked for it.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

You can monitor your results by tracking how many people open your emails, click on links and sign up to your mailing lists.

-

Measure your ROI - measure the number of leads generated by each campaign, and see which campaigns bring in the most conversions.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

You must continue learning and remain relevant in marketing.

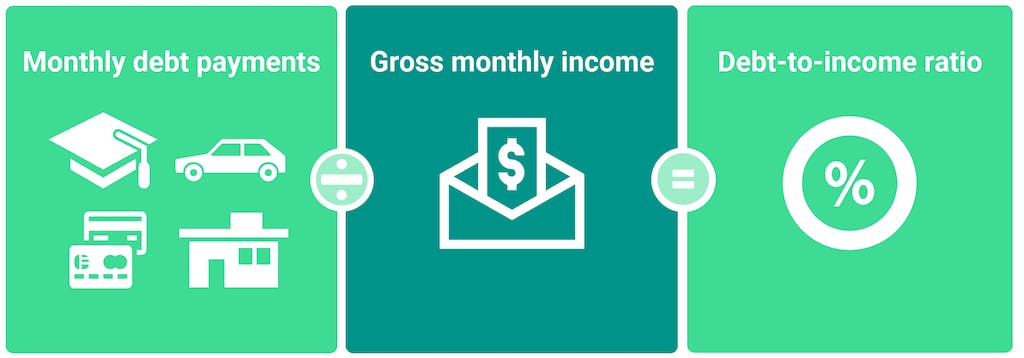

What is the limit of debt?

It's essential to keep in mind that there is such a thing as too much money. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. Spend less if you're running low on cash.

But how much do you consider too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. You'll be able to save more money once these are paid off.

You should also consider whether you would like to invest any surplus income. You could lose your money if you invest in stocks or bonds. However, if the money is put into savings accounts, it will compound over time.

As an example, suppose you save $100 each week. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. In eight years, your savings would be close to $3,000 In ten years you would have $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. This is quite remarkable. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 you would now have $57,000.

It is important to know how to manage your money effectively. If you don't, you could end up with much more money that you had planned.

What is the easiest passive income?

There are many options for making money online. However, most of these require more effort and time than you might think. How can you make extra cash easily?

The solution is to find what you enjoy, blogging, writing or selling. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here are 101 affiliate marketing tips and resources.

You could also consider starting a blog as another form of passive income. Again, you will need to find a topic which you love teaching. After you've created your website, you can start offering ebooks and courses to make money.

Although there are many ways to make money online you can choose the easiest. You can make money online by building websites and blogs that offer useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is called content marketing, and it's a great method to drive traffic to your website.

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles provide extra income for fun activities and bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types side hustles: active and passive. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles that are right for you fit in your daily life. Start a fitness company if you are passionate about working out. You might consider working as a freelance landscaper if you love spending time outdoors.

You can find side hustles anywhere. Side hustles can be found anywhere.

You might open your own design studio if you are skilled in graphic design. Or perhaps you have skills in writing, so why not become a ghostwriter?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles can't be just about making a living. They can help you build wealth and create freedom.

There are many ways to make money today so there's no reason not to start one.

What side hustles are most lucrative in 2022?

It is best to create value for others in order to make money. If you do this well, the money will follow.

Although you may not be aware of it, you have been creating value from day one. When you were little, you took your mommy's breastmilk and it gave you life. The best place to live was the one you created when you learned to walk.

As long as you continue to give value to those around you, you'll keep making more. Actually, the more that you give, the greater the rewards.

Everyone uses value creation every day, even though they don't know it. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

Today, Earth is home for nearly 7 million people. Each person creates an incredible amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

If you could find ten more ways to make someone's week better, that's $700,000. This is a lot more than what you earn working full-time.

Now, let's say you wanted to double that number. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling products, ideas, services, and information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. The real goal is to help other people achieve their goals.

You can get ahead if you focus on creating value. Use my guide How to create value and get paid for it.

Why is personal finance important?

Anyone who is serious about financial success must be able to manage their finances. Our world is characterized by tight budgets and difficult decisions about how to spend it.

Why should we save money when there are better things? Is there nothing better to spend our time and energy on?

Yes and no. Yes, because most people feel guilty if they save money. You can't, as the more money that you earn, you have more investment opportunities.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Financial success requires you to manage your emotions. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Unrealistic expectations may also be a factor in how much you will end up with. This is because you haven't learned how to manage your finances properly.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to Make Money Online Without Any Experience

There are many different ways to make money online. While some people like to use computers for work, others prefer to be outside and interact with others.

Regardless of your level of success, there is always more to be done. We will be looking at simple ways you can improve your life.

Since its beginnings, blogging is growing exponentially. Anyone can have a blog, and anyone with a computer is able to make money.

A blog is free and very easy to setup. Even if you don’t know much about blogging, all you need is a domain and a hosting provider.

Selling photos online can be one of the most lucrative ways to make an online income. It doesn’t really matter what your skills are with photography.

Only two things are required: a good digital camera and an image editing software such as Adobe Photoshop Elements. Once you have all the necessary tools, you can upload your images onto Fotolia to get high-quality photos that you can download.

Why not sell your skills? Whether you're great at writing articles or speak several languages fluently, there are plenty of places online where you can sell your expertise.

Elance is a site that links freelancers with businesses seeking their services. Post projects and let freelancers bid. The project will be completed by the highest bidder.

-

You can create an ebook and then sell it on Amazon

Amazon is the leading e-commerce site today. They offer a marketplace that allows people to sell and buy items.

This allows you to create an ebook and make it available through Amazon. This is a great option because you get paid per sale instead of per page read.

You can also teach abroad and earn extra money without having to leave your country. Teachers Pay Teachers helps students and teachers connect.

Teaching can be done in any subject: math, science or geography.

-

Google Write Adsense articles is another free website advertising system that google offers. You can place small advertisements on the pages of your website each time someone visits it. These ads appear when visitors visit any page.

You will earn more revenue the more traffic you get.

Digitally selling artwork is also possible. Many artists use sites like Etsy to list and sell their artwork.

Etsy makes it easy to create virtual shops that look just like real ones.

Students are becoming more interested in freelance work. More companies outsource jobs to contractors as the economy improves.

It's a win for both employees and employers. Employers will save money by no longer having to pay taxes or benefits. Employees benefit from having flexibility in their schedules while earning additional income.