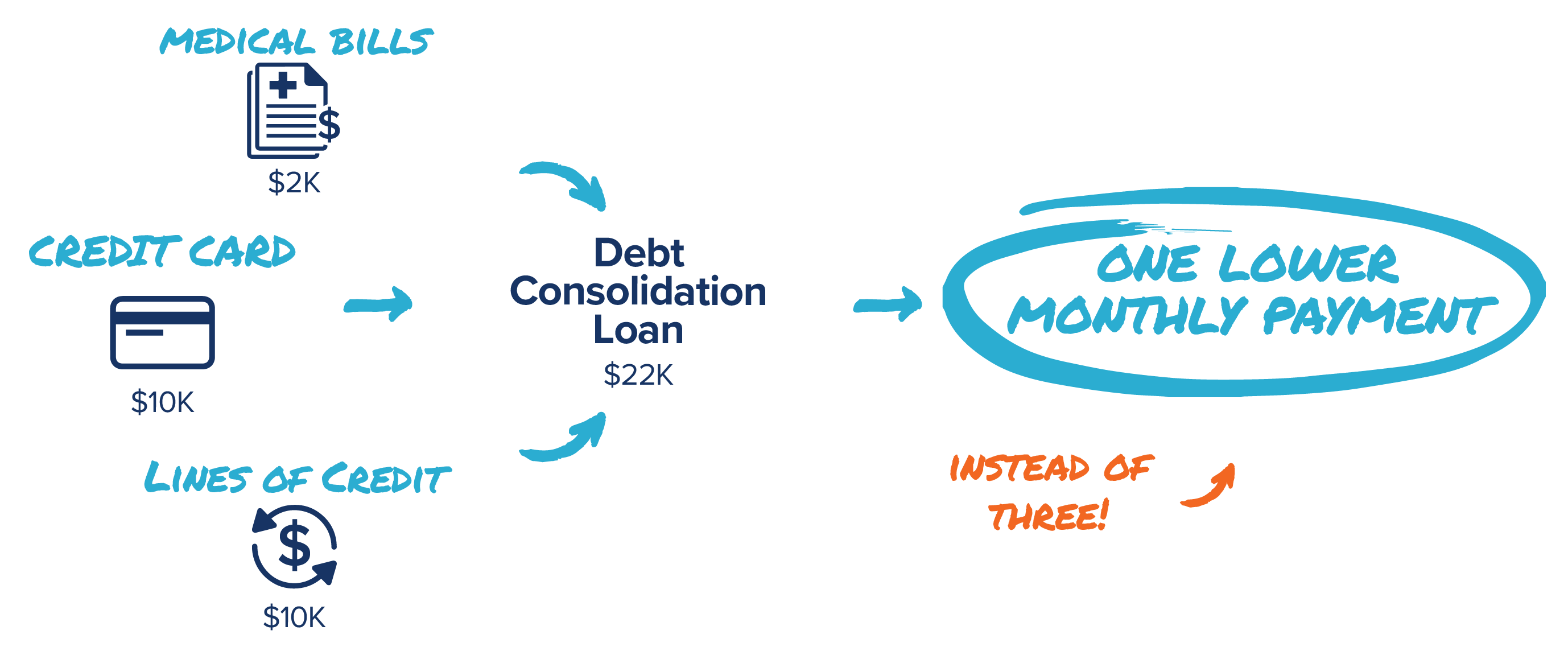

If you're struggling with debt and bad credit, you may be considering a bad credit debt consolidation loan. This type of loan may be more expensive than a traditional one, but it could also help you save money in the long run. A consolidation loan for bad credit can consolidate your debt, while also lowering your interest and payment. The terms of the loan will be determined by your lender after reviewing your credit history.

Comparison of balance transfer and debt consolidation

There are two options to address a debt problem: balance transfer and debt consolidation. The first method involves moving your debt from one card to another, usually one that offers lower interest rates. A balance transfer involves using the funds on a new card to pay off the balance on an old one. In both cases you'll need to budget your expenses to avoid getting into more debt.

Before you make a decision on which option to pursue, take the time to study the advantages and disadvantages. Reputable lenders will provide detailed information on their services and be licensed in your area. They will also hire certified and accredited counselors. You should also check with the local attorney general and consumer protection agency before taking any final decisions.

Online lenders

There are many options available to you if your credit is not perfect and you need a loan consolidation. You may only find lenders that specialize in this type or lending. They have very low minimum credit scores. You may be eligible for a debt consolidation loan if you have a score of 600 or less. However, your interest rates will likely be higher. A free credit score monitoring tool is available at many banks to help you assess your credit.

To make sure you get the best rate, it is a good idea to shop around. Compare several quotes from different debt consolidation loan companies. Be wary of scams. Watch out for aggressive sales representatives, quick-fix promises and "guaranteed” approvals. You should also avoid lenders that ask for upfront payments before loan approval. You should not pay upfront fees to a lender and wire transfer or prepaid cards should never be used.

Credit unions

If you have bad credit, you may want to consider using credit unions for bad credit debt consolidation. They are run by members and must conduct business responsibly. They may conduct a credit check on your behalf, much like a bank. They typically pull your credit history from at least one of the major credit bureaus. However, if you have strong derogatory information on your credit report, the process will be more difficult. Credit unions are also likely to subscribe to the ChexSystems Customer Banking Report.

Credit unions are able to offer flexible terms for those with poor credit. Because they operate under a cooperative model, these institutions are more likely than other banks and lending institutions to offer flexible terms. Credit unions typically offer personal loans at lower interest rates than credit cards.

Secured loans

If you have a bad credit history and want to consolidate your debt, a secured loan is a great option. Your home equity can help you qualify for a low-interest loan. This type of loan allows you to pay off all your other debts through one monthly payment. A variety of lenders offer secured loans to consolidate bad credit debt. Shop around to get the best deal.

Secured loans work in the same way as unsecured, but they need collateral. A home, car, savings account, or other collateral can be used, provided it is enough to cover the loan amount. If you have collateral that is worth enough to offset the risk, your lender will likely approve your loan application.

Credit line for home equity

A Home equity loan can help consolidate high-debt accounts. This loan can be secured by your home and requires no down payment. However, you need a favorable credit score to be approved. Most lenders require that you have at least 680. Some lenders will accept you even if your score is lower. To be approved, you may need to have less debt than your income. These loans have shorter terms and higher interest rates than regular loans.

Your home is the collateral for a home equity loan. You should be ready to miss payments. Failure to make payments could result in foreclosure which can cause you to lose your home. There may be additional costs, such a closing cost or home appraisal. The application process can take thirty to sixty days.

FAQ

How can rich people earn passive income?

There are two main ways to make money online. Another way is to make great products (or service) that people love. This is called "earning" money.

The second is to find a method to give value to others while not spending too much time creating products. This is called "passive" income.

Let's suppose you have an app company. Your job is to create apps. You decide to make them available for free, instead of selling them to users. This business model is great because it does not depend on paying users. Instead, advertising revenue is your only source of income.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how successful internet entrepreneurs today make their money. They are more focused on providing value than creating stuff.

Which side hustles are the most lucrative in 2022

It is best to create value for others in order to make money. You will make money if you do this well.

You may not realize it now, but you've been creating value since day 1. Your mommy gave you life when you were a baby. Learning to walk gave you a better life.

You will always make more if your efforts are to be a positive influence on those around you. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

Today, Earth is home for nearly 7 million people. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Imagine that you'd be earning more than you do now working full time.

Let's imagine you wanted to make that number double. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every day offers millions of opportunities to add value. This includes selling products, services, ideas, and information.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The ultimate goal is to assist others in achieving theirs.

To get ahead, you must create value. Start by downloading my free guide, How to Create Value and Get Paid for It.

What is the fastest way you can make money in a side job?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

It is also important to establish yourself as an authority in the niches you choose. It means building a name online and offline.

The best way to build a reputation is to help others solve problems. Ask yourself how you can be of value to your community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many ways to make money online.

You will see two main side hustles if you pay attention. The one involves selling direct products and services to customers. While the other involves providing consulting services.

There are pros and cons to each approach. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. Additionally, there is intense competition for these types of gigs.

Consulting is a great way to expand your business, without worrying about shipping or providing services. But, it takes longer to become an expert in your chosen field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. It will take some trial-and-error. But it will pay off big in the long term.

How much debt is considered excessive?

There is no such thing as too much cash. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. You should cut back on spending if you feel you have run out of cash.

But how much can you afford? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You'll never go broke, even after years and years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. Spend less than $2,000 per monthly if you earn $20,000 a year. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It is important to get rid of debts as soon as possible. This applies to student loans, credit card bills, and car payments. Once those are paid off, you'll have extra money left over to save.

It's best to think about whether you are going to invest any of the surplus income. You could lose your money if you invest in stocks or bonds. But if you choose to put it into a savings account, you can expect interest to compound over time.

For example, let's say you set aside $100 weekly for savings. Over five years, that would add up to $500. Over six years, that would amount to $1,000. In eight years, you'd have nearly $3,000 in the bank. When you turn ten, you will have almost $13,000 in savings.

In fifteen years you will have $40,000 saved in your savings. This is quite remarkable. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

This is why it is so important to understand how to properly manage your finances. You might end up with more money than you expected.

What's the difference between passive income vs active income?

Passive income is when you earn money without doing any work. Active income requires hardwork and effort.

If you are able to create value for somebody else, then that's called active income. You earn money when you offer a product or service that someone needs. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great as it allows you more time to do important things while still making money. Many people aren’t interested in working for their own money. People choose to work for passive income, and so they invest their time and effort.

Passive income doesn't last forever, which is the problem. If you wait too long before you start to earn passive income, it's possible that you will run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, Start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types of passive income streams:

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

What side hustles are the most profitable?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types side hustles: active and passive. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles are smart and can fit into your life. A fitness business is a great option if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles are available anywhere. Side hustles can be found anywhere.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you're an experienced writer so why not go ghostwriting?

You should do extensive research and planning before you begin any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Remember, side hustles aren't just about making money. Side hustles can be about creating wealth or freedom.

There are so many ways to make money these days, it's hard to not start one.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to Make Money Online

How to make money online today differs greatly from how people made money 10 years ago. Your investment strategy is changing. While there are many methods to generate passive income, most require significant upfront investment. Some methods can be more challenging than others. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out what kind of investor you are. If you're looking to make quick bucks, you might find yourself attracted to programs like PTC sites (Pay per click), where you get paid for simply clicking ads. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Research is essential before you make any commitment to any program. Review, testimonials and past performance records are all good places to start. You don't wish to waste your energy and time only to discover that the product doesn’t perform.

-

Start small. Do not jump into a large project. Instead, build something small first. This will help you learn the ropes and determine whether this type of business is right for you. When you feel confident, expand your efforts and take on bigger projects.

-

Get started now! You don't have to wait too long to start making money online. Even if a long-term employee, there's still time to build up a profitable portfolio of niche websites. All you need is a good idea and some dedication. Get started today and get involved!