Upstart loans can be a loan option that uses artificial Intelligence to help you find a better deal. The company claims that its process will allow you to receive a credit offer from multiple lenders, instead of just one, which will decrease the risk for both lender and consumer. The company also offers flexible payment options. You can pick when you pay, which is very helpful for credit builders. In addition, Upstart allows you to view your payment obligations online.

Fill out the application form before applying for an Upstart Loan. You'll need basic information like your address, employment history, education and income. Generally, applicants can receive a loan amount based on their credit score and other factors. But, not everyone is eligible for an Upstart loans. You may not get approved if you have a history of bankruptcy or other public records. If you have had a previous rejection, you will need a higher score to be approved for another loan.

Upstart lends to those with good, average or poor credit. They also offer a number of different types of loans, including car refinancing and small business loans. Although it is not a bank however, the Better Business Bureau (BBB) has accredited the company with an A+ rating.

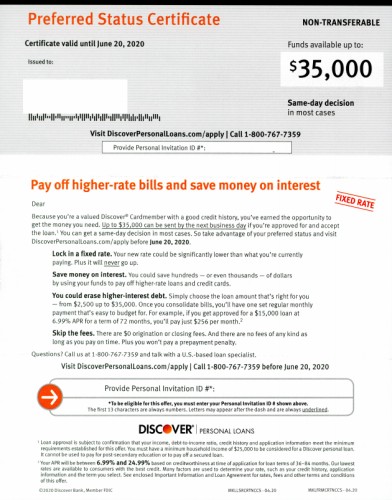

Upstart's personal loans include an origination fee ranging from 0% to 88% depending upon the amount. You'll also need to pay a 5% late fee on any past-due payments. Upstart will do a hard credit review after you submit the application. Because this is a difficult inquiry, it may temporarily lower your credit score. Switching from paper records to electronic records will cost you $10.

It's very easy to get an Upstart loan approved. Once you've registered, you'll be able to receive an initial rate proposal. Next, you will need to indicate the intended use of funds. Afterward, you'll be provided with a physical copy of the loan agreement. You can also schedule payments for the future but you'll need to track these down.

Upstart provides educational materials and resources. Upstart allows you to get financial advice, learn about managing your money and view your payments online. You don't have to sign up to a payment app or telephone service, unlike many other lending websites. This will allow you to keep track of your repayments.

For young people looking to improve their credit, Upstart is the best option. It doesn't depend on traditional credit scores and approves more borrowers that banks. Its AI-based underwriting makes it easier for borrowers to be approved for loans. This is because it considers many other factors such as education and employment history. However, it has higher interest rates than many of its competition.

Customers have reported issues with customer service and application processing. Despite this, the company is rated A+ with the BBB. It has also received a non-action letter by the Consumer Financial Protection Bureau. And, according to Trustpilot, the majority of reviews are positive.

FAQ

How does a rich person make passive income?

If you're trying to create money online, there are two ways to go about it. One way is to produce great products (or services) for which people love and pay. This is known as "earning" money.

The second is to find a method to give value to others while not spending too much time creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job is to develop apps. You decide to make them available for free, instead of selling them to users. It's a great model, as it doesn't depend on users paying. Instead, you rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how most successful internet entrepreneurs earn money today. They focus on providing value to others, rather than making stuff.

What is the easiest passive income?

There are many different ways to make online money. Many of these methods require more work and time than you might be able to spare. How can you make extra cash easily?

You need to find what you love. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is known as affiliate marketing and you can find many resources to help get started. Here are 101 affiliate marketing tips and resources.

Another option is to start a blog. Once again, you'll need to find a topic you enjoy teaching about. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many options for making money online, the most effective ones are the easiest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is called content marketing, and it's a great method to drive traffic to your website.

How to build a passive stream of income?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

That means understanding their needs and wants. This requires you to be able connect with people and make sales to them.

The next step is to learn how to convert leads in to sales. Finally, you must master customer service so you can retain happy clients.

You may not realize this, but every product or service has a buyer. Knowing who your buyer is will allow you to design your entire company around them.

You have to put in a lot of effort to become millionaire. A billionaire requires even more work. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Finally, you can become a millionaire. Finally, you must become a billionaire. You can also become a billionaire.

How does one become billionaire? You must first be a millionaire. To achieve this, all you have to do is start earning money.

You have to get going before you can start earning money. Let's look at how to get going.

What is the distinction between passive income, and active income.

Passive income is when you make money without having to do any work. Active income requires work and effort.

When you make value for others, that is called active income. It is when someone buys a product or service you have created. This could include selling products online or creating ebooks.

Passive income can be a great option because you can put your efforts into more important things and still make money. Many people aren’t interested in working for their own money. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. Start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

What side hustles will be the most profitable in 2022

To create value for another person is the best way to make today's money. You will make money if you do this well.

While you might not know it, your contribution to the world has been there since day one. When you were little, you took your mommy's breastmilk and it gave you life. When you learned how to walk, you gave yourself a better place to live.

You will always make more if your efforts are to be a positive influence on those around you. In fact, the more value you give, then the more you will get.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

Today, Earth is home for nearly 7 million people. Each person creates an incredible amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Imagine that you'd be earning more than you do now working full time.

Now, let's say you wanted to double that number. Let's say you found 20 ways to add $200 to someone's life per month. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day there are millions of opportunities for creating value. This includes selling products, ideas, services, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Ultimately, the real goal is to help others achieve theirs.

Create value to make it easier for yourself and others. Use my guide How to create value and get paid for it.

How much debt is too much?

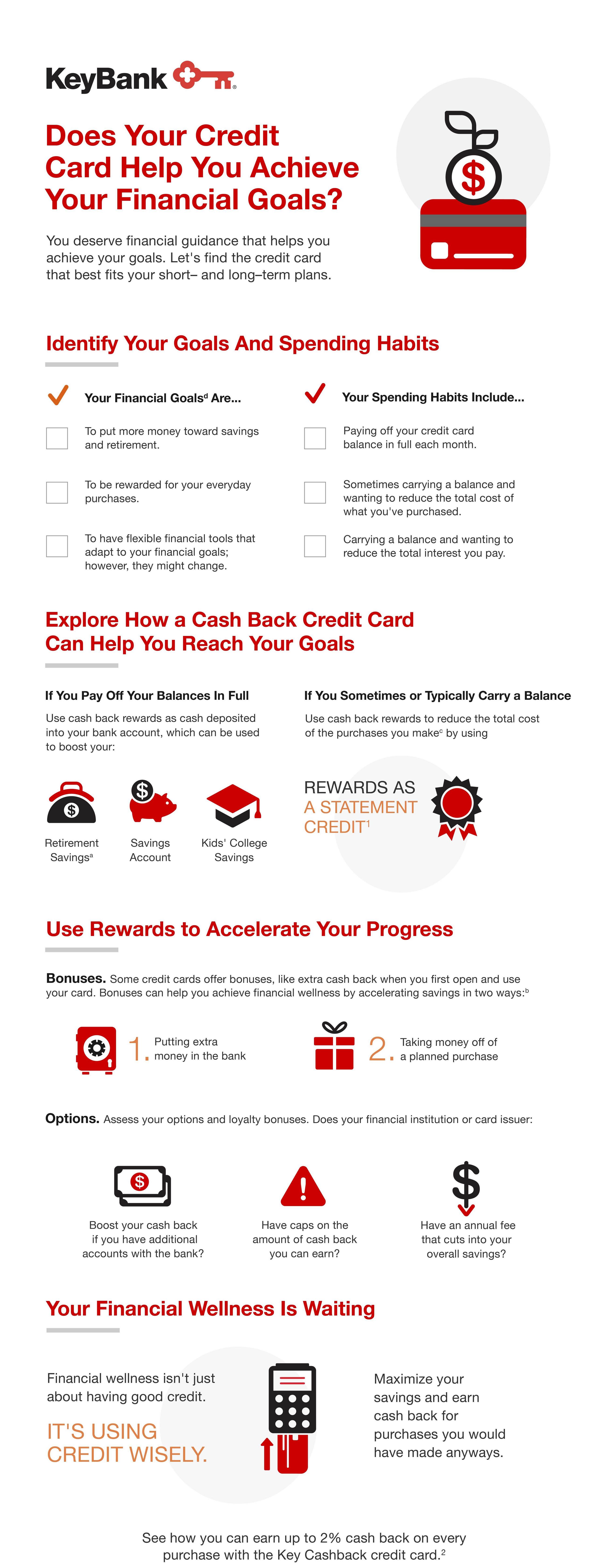

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. If you are running out of funds, cut back on your spending.

But how much can you afford? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. That way, you won't go broke even after years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. You shouldn't spend more that $2,000 monthly if your income is $20,000 If you earn $50,000, you should not spend more than $5,000 per calendar month.

This is where the key is to pay off all debts as quickly and easily as possible. This applies to student loans, credit card bills, and car payments. Once those are paid off, you'll have extra money left over to save.

You should also consider whether you would like to invest any surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. If you save your money, interest will compound over time.

As an example, suppose you save $100 each week. It would add up towards $500 over five-years. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. Now that's quite impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 you would now have $57,000.

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money at Home

You can always improve no matter how much money online. But even the most successful entrepreneurs struggle to grow their businesses and increase profits.

Problem is, when you are just starting out, it can be easy to get stuck in the rut and focus on revenue instead of growing your business. You might find yourself spending more time on product development than marketing. You might even neglect customer service.

That's why it's critical to periodically evaluate your progress--and ask yourself whether you're improving your bottom line or simply maintaining the status quo. These are five easy ways to increase income.

Productivity isn’t about the output. To be productive, you must also be able accomplish your tasks. Delegate the tasks that require the most energy and effort in your job to others.

For example, if you're an eCommerce entrepreneur, you could hire virtual assistants to handle social media, email management, and customer support.

A team member could be assigned to create blog posts, and another person to manage your lead generation campaigns. When delegating, choose people to help you achieve your goals faster and better.

-

Focus on Sales instead of Marketing

Marketing doesn't necessarily mean spending lots of money. Some of the greatest marketers are not paid employees. They're self-employed consultants who earn commissions based on the value of their services.

Instead of advertising on TV, radio, or print ads, you can look into affiliate programs, which allow you promote other companies' products and/or services. To make sales, you don’t necessarily have to buy costly inventory.

-

Hire An Expert To Do What You Can't

To fill in the gaps, you can hire freelancers. If you don't have the skills to design graphics, you can hire a freelancer.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be tedious when you work as an independent contractor. It can be particularly tedious if you have multiple customers who want different things.

FreshBooks and Xero are two apps that make it simple to invoice customers. The app allows you to enter all client information once, and then send invoices directly to them.

-

You can sell more products with affiliate programs

Affiliate programs can be great because you don't need to have stock. And you don't need to worry about shipping costs either. All you need to do is set up a link between your website and the vendor's site. Once someone purchases from the vendor's site, they will pay you a commission. Affiliate programs can help build a reputation and increase your income. If you can provide high-quality content and services, you will attract your audience.