When negotiating with debt collectors, the first thing to do is learn the details of your debt. You can then create a realistic proposal once you have the details. You can also contest the debt, request the name the original creditor, or request written verification. When trying to negotiate, debt collectors often make common errors.

Negative aspects of negotiations with debt collectors

When negotiating with a debt collector, the first step is to be prepared with realistic information. A debt collector might try to force you to agree to a payment plan that is unrealistic. This will only delay the inevitable default and hurt your credit report. You may also find that the debt collector uses emotional tactics to get your cash. Remain calm and professional. Present your financial situation clearly and the debt collector may be persuaded to accept the terms.

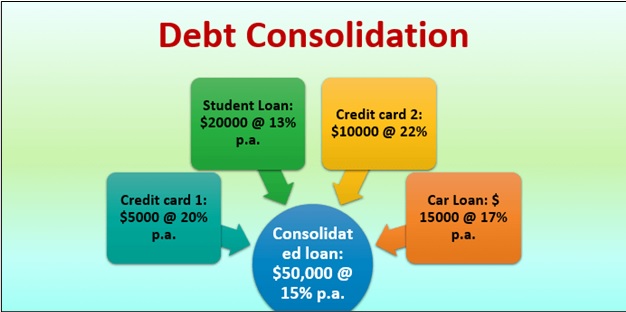

To negotiate with a debt collector, the next step is to talk with the original creditor. Talk to the original creditor, not the collector. The original creditor might be willing and able to negotiate. They may even accept a lower amount. You can also negotiate the interest rate of your debt. This can reduce the total amount due.

What steps should you take before you negotiate

You should be familiar with the tactics of debt collectors before you attempt to negotiate with them. They will often try to collect more money than they owe. Debt negotiation is not about getting more money than you can afford. It is important to not give them any personal information such as income or other financial obligations.

It's not uncommon for debt collectors to ask you to confirm that you owe them money. However, you should never confirm this information. Fraudsters are known to impersonate debt collectors, and then use that information to steal your identity. Remain calm and respectful. Also, keep a detailed record of all communications. You should not give out too many personal details, as they could be used against to you if it isn't possible to pay. National debt relief may be available for you if you are not able pay your debt fully.

Avoid the common mistakes made in debt collection

Negotiating directly with creditors is a great way to reduce your debt and stop creditors calling. If you want to negotiate with success, avoid common errors made by debt collectors. It is important to remember that a debt collector's main goal is to collect as much money as possible, so it is essential to avoid letting them harass or threaten you. They understand that consumers who are under pressure tend to make mistakes and use this knowledge to their advantage.

Although a debt collector may seem like they hold all the cards, remember that you have legal protections as a debtor. For instance, you are protected under several federal and state laws, including the Fair Debt Collection Practices Act. This law will protect you and allow you to get back any money you owe. Negotiating with creditors can help you avoid violating any of the laws. Avoiding these errors will help you save money and reduce your credit card debt.

Requirements to negotiate with a debt collector

A realistic budget is the first thing you need to do when talking to debt collectors. You may be pushed by debt collectors to agree to a payment plan that isn't sustainable. This will only delay the inevitable default. It will also hurt your credit rating. It might not be in your best financial interest to pay off the entire debt at once.

After you have established your financial position, it is time to improve your negotiation skills. You should know how much you can pay and what is the maximum amount you are willing to pay. It is tempting to make the highest possible offer, but it is best not to. A reasonable starting amount is 25% of your outstanding debt. This will allow you to negotiate with the creditor till you reach a reasonable amount. You should also be patient during the negotiations. You may need to contact their customer service department if you aren't satisfied with the creditor’s offer.

FAQ

Which passive income is easiest?

There are tons of ways to make money online. Many of these methods require more work and time than you might be able to spare. How can you make it easy for yourself to make extra money?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. and monetize that passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

This is affiliate marketing. There are lots of resources that will help you get started. Here are 101 affiliate marketing tips and resources.

Another option is to start a blog. You'll need to choose a topic that you are passionate about teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many online ways to make money, but the easiest are often the best. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you have created your website, share it on social media such as Facebook and Twitter. This is known content marketing.

What side hustles will be the most profitable in 2022

The best way to make money today is to create value for someone else. You will make money if you do this well.

Even though you may not realise it right now, you have been creating value since the beginning. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

If you keep giving value to others, you will continue making more. In fact, the more value you give, then the more you will get.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

In actuality, Earth is home to nearly 7 billion people right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if your hourly value is $1, you could create $7 million annually.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. This is a lot more than what you earn working full-time.

Let's imagine you wanted to make that number double. Let's assume you discovered 20 ways to make $200 more per month for someone. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day there are millions of opportunities for creating value. This includes selling products, ideas, services, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Ultimately, the real goal is to help others achieve theirs.

Focus on creating value if you want to be successful. My free guide, How To Create Value and Get Paid For It, will help you get started.

How does rich people make passive income from their wealth?

There are two options for making money online. Another way is to make great products (or service) that people love. This is what we call "earning money".

The second is to find a method to give value to others while not spending too much time creating products. This is "passive" income.

Let's say you own an app company. Your job is developing apps. You decide to make them available for free, instead of selling them to users. This is a great business model as you no longer depend on paying customers. Instead, you rely upon advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how most successful internet entrepreneurs earn money today. They focus on providing value to others, rather than making stuff.

How much debt are you allowed to take on?

It is vital to realize that you can never have too much money. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. When you run out of money, reduce your spending.

But how much do you consider too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. You won't run out of money even after years spent saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000, you should' t spend more than $2,000 per month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

The key here is to pay off debts as quickly as possible. This includes student loans, credit card debts, car payments, and credit card bill. You'll be able to save more money once these are paid off.

It's best to think about whether you are going to invest any of the surplus income. You could lose your money if you invest in stocks or bonds. However, if the money is put into savings accounts, it will compound over time.

As an example, suppose you save $100 each week. That would amount to $500 over five years. Over six years, that would amount to $1,000. In eight years, your savings would be close to $3,000 It would take you close to $13,000 to save by the time that you reach ten.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. This is quite remarkable. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. A poor financial management system can lead to you spending more than you intended.

What is the distinction between passive income, and active income.

Passive income is when you make money without having to do any work. Active income requires effort and hard work.

Your active income comes from creating value for someone else. It is when someone buys a product or service you have created. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great because you can focus on other important things while still earning money. But most people aren't interested in working for themselves. Instead, they decide to focus their energy and time on passive income.

Problem is, passive income won't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types to passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

How to build a passive income stream?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

This means that you must understand their wants and needs. It is important to learn how to communicate with people and to sell to them.

The next step is to learn how to convert leads in to sales. To retain happy customers, you need to be able to provide excellent customer service.

Although you might not know it, every product and service has a customer. Knowing who your buyer is will allow you to design your entire company around them.

It takes a lot of work to become a millionaire. To become a billionaire, it takes more effort. Why? To become a millionaire you must first be a thousandaire.

And then you have to become a millionaire. Finally, you must become a billionaire. It is the same for becoming a billionaire.

How do you become a billionaire. You must first be a millionaire. All you have to do in order achieve this is to make money.

You have to get going before you can start earning money. Let's discuss how to get started.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

How to make money at home

There's always room to improve, no matter how much you make online. Even the most successful entrepreneurs face challenges in growing their businesses and increasing profits.

It's easy to get lost in a rut when you start a business. Instead of focusing on growing your company, you can focus only on increasing revenue. You may spend more time on marketing rather than product development. Or you could neglect customer services altogether.

That's why it's critical to periodically evaluate your progress--and ask yourself whether you're improving your bottom line or simply maintaining the status quo. These are five easy ways to increase income.

-

Increase your Productivity

Productivity is not just about output. It's also about being able to do tasks well. So figure out which parts of your job require the most effort and energy, and delegate those jobs to someone else.

Virtual assistants can be employed to help you manage customer support, social media management, and email management.

Another option is to assign one person to write blog posts and another to manage lead-generation campaigns. Delegating should be done with people who will help you accomplish your goals quicker and better.

-

Marketing is not the most important thing.

Marketing doesn’t always have to mean spending a lot. The best marketers don't have to be paid. They are self-employed, and they earn commissions based the value of what they do.

Instead of advertising products on television, radio and in print ads, consider affiliate programs that allow you to promote the goods and services of other businesses. To generate sales, you don't need to purchase expensive inventory.

-

For the impossible, hire an expert

Freelancers can be hired to fill in the gaps if you don't have enough expertise. You could hire a freelance graphic designer to create graphics for your website if you aren't familiar with graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be tedious when you work as an independent contractor. Invoicing can be especially difficult if you have multiple clients that want different things.

FreshBooks and Xero allow you to quickly and easily invoice your customers. All your client information can be entered once and invoices sent directly from the app.

-

Promote More Products with Affiliate Programs

Affiliate programs are great as they allow you to sell products and not have to hold stock. There are no shipping fees to worry about. Simply create a hyperlink between your website and that of the vendor. When someone buys from the vendor, you will receive a commission. Affiliate programs are a great way to build your brand and make more money. If you can provide high-quality content and services, you will attract your audience.