Consolidating debt has many benefits. It can reduce interest fees, improve your credit score, streamline repayments, and even lower your monthly payments. It is important that you understand the cons. We will be discussing the benefits and drawbacks of debt consolidation. A debt consolidation loan may not only reduce interest costs but also allow for higher payments.

Lower-interest debt consolidation reduces interest charges

A consolidation loan with lower interest rates can be a great option if you are in credit card debt. This is a great way of reducing the amount of bills you have accrued since the recent financial crisis. These tips will make debt consolidation easier for you.

By consolidating your debts into one low interest loan, you can reduce interest rates and lower your monthly payments. This method will free up your credit line and eliminate collection calls. Applying for a new mortgage will temporarily lower your credit score. If you pay your bills on time and consolidate your debt, you will see a rise in your credit score.

It can improve your credit score

If you're in debt, you may be wondering whether debt consolidation can improve your credit score. The answer depends on how you approach debt consolidation. You may have to take out a loan or credit line, which can lower your score. Others involve negotiating for a reduced payment. You may decide that debt consolidation is the right choice for you based on your current credit score, your credit utilization rate, and your payment history.

Your payment history is a key factor in determining your credit score. This makes it important to pay on time. Although a consolidation loan to consolidate debt will reduce your credit score, the monthly payments will be much easier. Because your payment history makes up 35 percent of your credit score, paying on time can improve your credit score.

It streamlines repayment

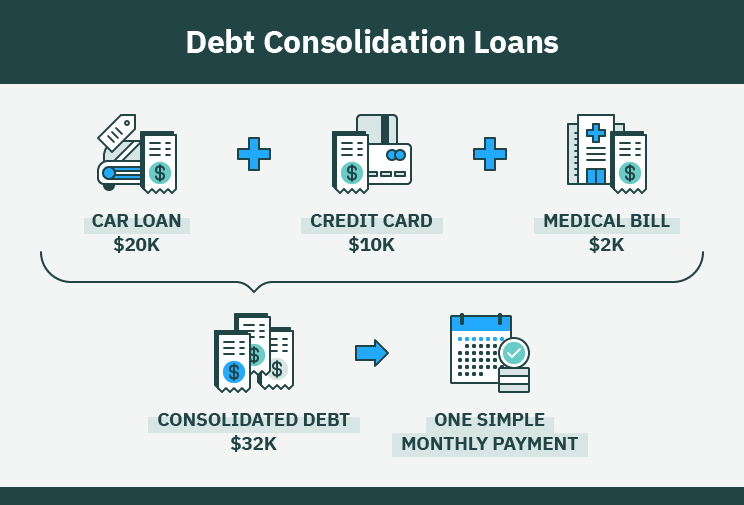

For those who wish to simplify their payment management, consolidation can be a great option. People can lower their monthly payments with debt consolidation. They combine all their debts into a single loan/credit card. They then use the funds to pay off any outstanding balances. This can make repayments much easier and increase their credit score.

Online or through a credit union or bank, you can apply for a consolidation loan to consolidate debt. After approval, funds can be made available within a few working days. This money can be used for your existing debts. The lender can also pay them off.

It can raise your payments

You may be wondering whether or not debt consolidation is right for you. The benefits of debt consolidation include a lower monthly payment and a lower interest rate. Compare multiple loan offers to find the best deal. You can also use a debt consolidation service to help you select the best repayment period for your financial situation. A shorter repayment period may mean higher monthly payments, but it will save you more money over the term of the loan. Consolidation is a great tool to manage your debts. It allows you to better plan your finances and reduce your monthly payment.

Although debt consolidation may seem like a good solution for you, there are some drawbacks as well. The main problem is the high interest rate. The benefit of debt consolidation is the opportunity to pay off your debt faster. It will mean that you only have one lender.

It can raise your interest-rate

Consolidating debt can help you save money, but it may come at a higher monthly cost. Prepayment penalties and origination charges are common for debt consolidation loans. These fees can decrease the savings due to the lower interest rates. These fees usually range from one to five percent on the total loan amount. Before applying for a debt consolidation loan, you should carefully review the terms and fees.

In the event that you do not pay your bills in time, credit card companies could raise your interest rate. While debt consolidation loans will often consolidate your credit card balances into a single payment, they can damage your credit score. You should plan your monthly budget carefully and make sure you use autopay or another method to avoid missing payments. Your lender should be notified if you are experiencing any financial difficulties that might cause you not to pay.

FAQ

What's the best way to make fast money from a side-hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. This means that you need to build a reputation both online and offline.

Helping others solve problems is the best way to establish a reputation. Ask yourself how you can be of value to your community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

You will see two main side hustles if you pay attention. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has its pros and cons. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. It takes more time to become an expert in your field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. This takes some trial and errors. However, the end result is worth it.

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles can also be a great way to save money for retirement, have more time flexibility, or increase your earning potential.

There are two types: active and passive side hustles. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles that work for you are easy to manage and make sense. Consider starting a business in fitness if your passion is working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

You can find side hustles anywhere. Side hustles can be found anywhere.

One example is to open your own graphic design studio, if graphic design experience is something you have. Maybe you're a writer and want to become a ghostwriter.

You should do extensive research and planning before you begin any side hustle. So when an opportunity presents itself, you will be prepared to take it.

Side hustles are not just about making money. They can help you build wealth and create freedom.

There are so many ways to make money these days, it's hard to not start one.

How can a novice earn passive income as a contractor?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You might have some ideas. If you do, great! If you do, great!

Online earning money is easy if you are looking for opportunities that match your interests and skills.

You can create websites or apps that you love, and generate revenue while sleeping.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. If you enjoy it, you will stick with the decision for the long-term.

Once you've identified a product/service which you would enjoy helping others to buy, you will need to determine how to monetize that product or service.

This can be done in two ways. The first is to charge a flat-rate for your services (like freelancers) and the second is per project (like agencies).

You'll need promotion for your rates in either case. This can be done via social media, emailing, flyers, or posting them to your list.

These are three ways to improve your chances of success in marketing your business.

-

Be a professional in all aspects of marketing. You never know who may be reading your content.

-

Know your subject matter before you speak. No one wants to be a fake expert.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. You can send a recommendation to someone who has asked for it.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Ask your family and friends for feedback.

-

Try different strategies - you may find that some work better than others.

-

Learn and keep growing as a marketer to stay relevant.

What is the best passive income source?

There are many options for making money online. Most of them take more time and effort than what you might expect. How can you make it easy for yourself to make extra money?

Finding something you love is the key to success, be it writing, selling, marketing or designing. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here are some examples of 101 affiliate marketing tools, tips & resources.

Another option is to start a blog. It's important to choose a topic you are passionate about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

Although there are many ways to make money online you can choose the easiest. You can make money online by building websites and blogs that offer useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is content marketing. It's an excellent way to bring traffic back to your website.

How do you build passive income streams?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

This means that you must understand their wants and needs. You need to know how to connect and sell to people.

Then you have to figure out how to convert leads into sales. You must also master customer service to retain satisfied clients.

Although you might not know it, every product and service has a customer. If you know who this buyer is, your entire business can be built around him/her.

A lot of work is required to become a millionaire. To become a billionaire, it takes more effort. Why? To become a millionaire you must first be a thousandaire.

And then you have to become a millionaire. You can also become a billionaire. It is the same for becoming a billionaire.

How can someone become a billionaire. It starts with being a millionaire. All you have do is earn money to get there.

You must first get started before you can make money. Let's discuss how to get started.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You no longer have to worry about paying rent or utilities every month.

And learning how to manage your money doesn't just help you get ahead. It makes you happier overall. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

Who cares about personal finances? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. This leaves just two hours per day for all other important activities.

When you master personal finance, you'll be able to take advantage of that time.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

To be successful online, you need to learn how to get to sleep when you are awake. This means learning to do more than wait for someone to click on your link or buy your product. It is possible to make money while you are sleeping.

You must be able to build an automated system that can make money without you even having to move a finger. This requires you to master automation.

It would be beneficial to learn how to build software systems that do tasks automatically. By doing this, you can make money while you sleep. You can even automate the tasks you do.

You can find these opportunities by creating a list of daily problems. Ask yourself if you can automate these problems.

Once you have done this, you will likely realize that there are many ways you can generate passive income. The next step is to determine which option would be most lucrative.

A website builder, for instance, could be developed by a webmaster to automate the creation of websites. Perhaps you are a graphic artist and could use templates to automate the production logos.

A software program could be created if you are an entrepreneur to allow you to manage multiple customers simultaneously. There are hundreds of options.

Automating a problem can be done as long as you have a creative solution. Automation is key to financial freedom.