There are many options available for consolidating student debt. These include Direct Consolidation Loans and Refinancing. There are many alternatives to defaulting in student loans. So that you can make an informed decision, it is important to consider all options. Consolidating student loan debts is free from fees and other responsibilities.

Laurel Road

Laurel Road might be an option if your student loans are being refinanced. The company offers refinancing options with no maximum cap and up to 20 years. Other benefits are also offered by the company to its customers. Their ability to offer payment plans that include the possibility of extension, is one of their advantages.

Laurel Road offers refinance of federal and private student loan loans. You must be a citizen or permanent resident of the United States to qualify. You will also need to have a degree.

Direct Consolidation loan

Consolidation loans for students are offered by the Federal Direct Student Loan Program. These loans combine several student loan debts into one loan. This results in lower monthly payment and a longer repayment term. Consolidation Loans are especially beneficial for those with large amounts of debt. However, not everyone is a good candidate for consolidation loans.

If you want to take advantage of this loan, there are a few things you need to know. First of all, you must have at least one federal student loan. For you to be eligible, your federal student loan must be in active payment, have a grace time, and be on a preapproved repayment plan. There are four income-driven repayment programs to choose from.

Refinancing

You should remember these things when refinancing student loan debt. First, make sure you have a high enough credit score. Your credit score can be damaged by late payments and defaulting on student loan payments. Second, remember to make use of any grace periods offered by your lender. Even though defaults and late payments are bad, taking advantage of grace periods offered by your lender can improve your credit score as well as lower your monthly payments.

Refinancing student debt is a difficult process. When considering whether or not to approve an application for a loan, lenders will consider a borrower’s credit score and financial obligations. If you don't have an excellent credit score, your odds of getting approved will be slim. Income will also be important.

Alternatives to defaulting student loans

There are many options available to you if you find yourself in a financial bind and cannot afford student loans. You should first consider deferment. This allows you to make monthly payment based on your income. Also, be aware that default can have serious consequences. Defaulting on a student loan can hurt your credit score and make it harder for you to get additional loans in the future.

You can apply for forbearance, which is a form of deferment. You should consider applying for forbearance if you have a job that allows deferment of payments for a short time. A Public Service Loan Forgiveness program may also apply to you if the job you find is in a nonprofit agency or government agency. To qualify, you must make 120 qualifying payments.

FAQ

What side hustles can you make the most money?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles can also be a great way to save money for retirement, have more time flexibility, or increase your earning potential.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles that work for you are easy to manage and make sense. Consider starting a business in fitness if your passion is working out. If you love to spend time outdoors, consider becoming an independent landscaper.

There are many side hustles that you can do. You can find side hustles anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you're an experienced writer so why not go ghostwriting?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles don't have to be about making money. Side hustles are about creating wealth and freedom.

With so many options to make money, there is no reason to stop starting one.

What are the most profitable side hustles in 2022?

To create value for another person is the best way to make today's money. If you do this well the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. Your mommy gave you life when you were a baby. When you learned how to walk, you gave yourself a better place to live.

As long as you continue to give value to those around you, you'll keep making more. Actually, the more that you give, the greater the rewards.

Value creation is a powerful force that everyone uses every day without even knowing it. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

Today, Earth is home for nearly 7 million people. That means that each person is creating a staggering amount of value daily. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

If you could find ten more ways to make someone's week better, that's $700,000. You would earn far more than you are currently earning working full-time.

Now, let's say you wanted to double that number. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day offers millions of opportunities to add value. This includes selling ideas, products, or information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Helping others achieve theirs is the real goal.

If you want to get ahead, then focus on creating value. You can start by using my free guide: How To Create Value And Get Paid For It.

How to build a passive income stream?

To consistently earn from one source, you need to understand why people buy what is purchased.

That means understanding their needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

You must then figure out how you can convert leads into customers. The final step is to master customer service in order to keep happy clients.

This is something you may not realize, but every product or service needs a buyer. If you know who this buyer is, your entire business can be built around him/her.

You have to put in a lot of effort to become millionaire. It takes even more work to become a billionaire. Why? To become a millionaire you must first be a thousandaire.

Finally, you can become a millionaire. You can also become a billionaire. The same is true for becoming billionaire.

How can someone become a billionaire. It all starts with becoming a millionaire. You only need to begin making money in order to reach this goal.

But before you can begin earning money, you have to get started. Let's discuss how to get started.

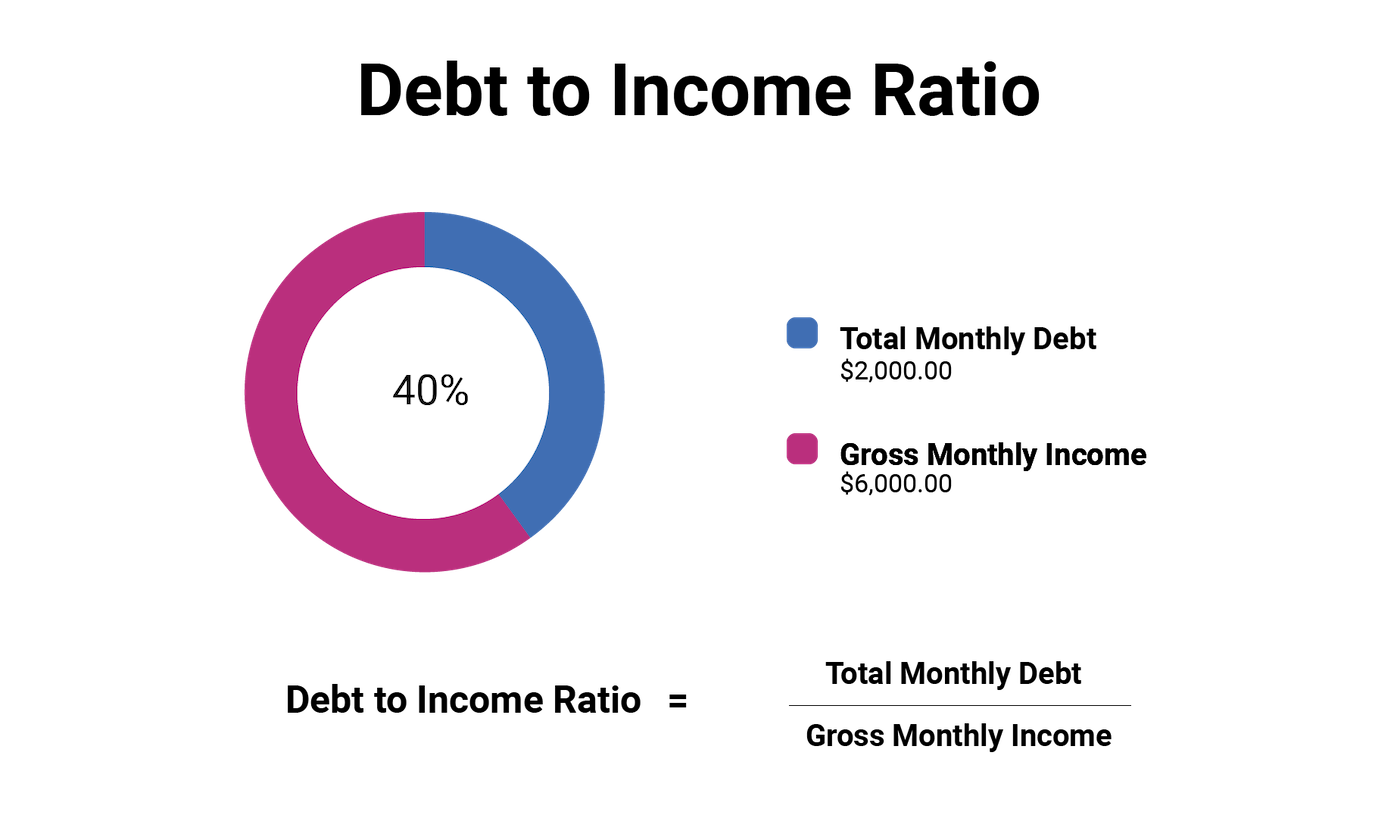

How much debt is too much?

It is essential to remember that money is not unlimited. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. If you are running out of funds, cut back on your spending.

But how much do you consider too much? There is no universal number. However, the rule of thumb is that you should live within 10%. You'll never go broke, even after years and years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. If you earn $50,000, you should not spend more than $5,000 per calendar month.

The key here is to pay off debts as quickly as possible. This includes credit card bills, student loans, car payments, etc. Once those are paid off, you'll have extra money left over to save.

It is best to consider whether or not you wish to invest any excess income. You may lose your money if the stock markets fall. However, if the money is put into savings accounts, it will compound over time.

Consider, for example: $100 per week is a savings goal. Over five years, that would add up to $500. In six years you'd have $1000 saved. You'd have almost $3,000 in savings by the end of eight years. In ten years you would have $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. Now that's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000 in savings, you would have more than 57,000.

You need to be able to manage your finances well. A poor financial management system can lead to you spending more than you intended.

Why is personal finance so important?

For anyone to be successful in life, financial management is essential. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why should we save money when there are better things? What is the best thing to do with our time and energy?

Yes and no. Yes because most people feel guilty about saving money. It's not true, as more money means more opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

It is important to learn how to control your emotions if you want to become financially successful. You won't be able to see the positive aspects of your situation and will have no support from others.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you aren't able to manage your finances effectively.

After mastering these skills, it's time to learn how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the difference between passive and active income?

Passive income is when you make money without having to do any work. Active income requires effort and hard work.

When you make value for others, that is called active income. Earn money by providing a service or product to someone. Examples include creating a website, selling products online and writing an ebook.

Passive income can be a great option because you can put your efforts into more important things and still make money. But most people aren't interested in working for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem with passive income is that it doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

It is possible to burn out if your passive income efforts are too intense. It is best to get started right away. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - These include buying land, flipping houses and investing in real estate.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

How to make money online without any experience

There are many different ways to make money online. While some people like to use computers for work, others prefer to be outside and interact with others.

No matter your status, there's always room for improvement. Here are some simple ways that you can improve your daily life.

Since its inception, the popularity of blogging has increased exponentially. Anyone can have a blog, and anyone with a computer is able to make money.

A blog isn't only free but also very simple to set up. If you don't know anything about blogging, you only need a domain name and hosting service.

One of the best ways to make money online is by selling photos. It doesn’t matter how skilled you are with a camera.

A decent image editing program such as Adobe Photoshop Elements and a high-quality digital camera are all you need. Once you have those items, you are able to upload your images to Fotolia, where millions of people visit every day to download high-quality photographs.

Selling skills is a great way to make money if you have them. No matter if you're an expert at writing articles, or can speak multiple languages fluently there are plenty online that will sell your knowledge.

Elance is a site that connects freelancers and businesses looking to hire them. Freelancers are asked to bid on projects that they have. The project will be completed by the highest bidder.

-

Make an ebook and sell it on Amazon

Amazon is the leading e-commerce site today. They offer a marketplace where people can buy and sell items.

This can be done by creating an ebook that you sell through Amazon. This is a great choice because you get paid per sales and not per page.

Teaching abroad is another way you can earn extra cash, even if your home country is not the best. Teachers Pay Teachers allows you to connect with teachers who are looking for English lessons.

Any subject can be taught, including history, geography and art.

-

Google Write Adsense is another popular way to advertise on your website. When someone visits your website, you place small advertisements throughout the pages of the website. These ads appear when visitors visit any page.

The more traffic you have, the more you will make.

It is possible to also sell your artwork digitally. To list and sell their art, many artists use Etsy.

Etsy lets users create virtual shops that look and act like real stores.

-

You can become a freelancer

Freelancing is becoming increasingly popular among college graduates. As the economy continues to improve, more companies are outsourcing jobs to independent contractors.

It's a win-win situation for both employers and employees. Employers are able to save money as they don't have to pay any benefits or payroll taxes. Employees enjoy flexibility and earn additional income by being able to adjust their work hours.