There are many ways you can avoid paying a civil judgement. There are several ways to avoid paying a civil judgment. You can either challenge it or hire a lawyer to help you. Or, you can pay the lump sum directly to your creditor. Nonprofit credit counselors may be available for help if your budget is limited.

Answering debtor interrogatories

The court can issue a warrant requiring debtors to answer questions if they have not appeared in court for at least six months. The court then sends a copy of its order to the debtor, returning receipt requested, via certified mail.

Debtors can avoid civil judgments by answering interrogatories. This gives them ample time to conceal assets or move them out of creditor's control. A debtor can move his or her bank accounts without an interrogatories, just as garnishments do. Moreover, garnishments and levies are more effective in enforcing the judgment against assets that are already known by the creditor.

Stipulated judgement

Debtors have many options when a stipulated judgement is issued. One option is to pay the creditor directly. This is risky and could lead to default on the judgment. It is better to choose a judgment that allows for a grace period. This will increase the debtor's chances of compliance.

Another option is to negotiate your settlement. By doing this, you can avoid a default and a stipulated judgment on your credit report. Also, negotiate the interest rate. If possible, opt for zero percent interest. If the creditor agrees, you can avoid paying the entire amount.

Renewed judgment

A creditor might decide to renew a judgment when a judgment is due. There are several ways to avoid having to pay a new judgment. The first thing you should do is find the details of the judgment. This information includes the name and title of the judgment debtor, case number, title of court and dates of previous judgement renewals. You can find most of this information in the Abstract of Judgment. The Superior Court, however, requires that you use the Application for Renewal of Judgment and Notice of Renewal of Judgment.

You could also try to negotiate with your creditor. If you can prove the judgment invalid, a creditor could be open to discussing a new arrangement. If you can't negotiate with the creditor, you can still have the judgment dropped from your credit report. A creditor may have passed away or gone out of business, so the judgment is no longer valid.

Tenancy through the wholeties

Although it is possible to avoid paying a civil judgement by using a tenant by the entiretyties, this can be very risky. It could result in you being sued by either a creditor and/or an injured party. This method is not without risks, such as legal malpractice.

If you have joint obligations, a tenancy for the entireties can be beneficial. You can still use this option to preserve your marital residence, but it would not erase your homestead exemption. Tenancy by the entireties doesn't remove a creditor from any preexisting mortgages on the property. It is also illegal for a creditor to commit fraud using tenancy-by-the-elements.

FAQ

How much debt is considered excessive?

It's essential to keep in mind that there is such a thing as too much money. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. When you run out of money, reduce your spending.

But how much should you live with? While there is no one right answer, the general rule of thumb is to live within 10% your income. Even after years of saving, this will ensure you won't go broke.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You should not spend more than $2,000 a month if you have $20,000 in annual income. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

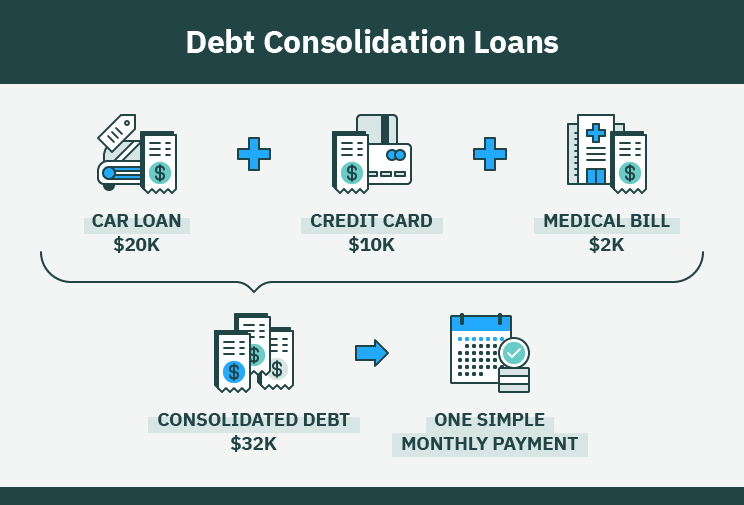

The key here is to pay off debts as quickly as possible. This includes student loans, credit cards, car payments, and student loans. Once those are paid off, you'll have extra money left over to save.

You should also consider whether you would like to invest any surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. However, if the money is put into savings accounts, it will compound over time.

Let's take, for example, $100 per week that you have set aside to save. That would amount to $500 over five years. In six years you'd have $1000 saved. In eight years, your savings would be close to $3,000 By the time you reach ten years, you'd have nearly $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. That's pretty impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. You'd have more than $57,000 instead of $40,000

It is important to know how to manage your money effectively. Otherwise, you might wind up with far more money than you planned.

Which side hustles are the most lucrative in 2022

To create value for another person is the best way to make today's money. If you do this well the money will follow.

While you might not know it, your contribution to the world has been there since day one. Your mommy gave you life when you were a baby. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. In fact, the more value you give, then the more you will get.

Value creation is an important force that every person uses every day without knowing it. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

There are actually nearly 7 billion people living on Earth today. That means that each person is creating a staggering amount of value daily. Even if you created $1 worth of value an hour, that's $7 million a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Think about that - you would be earning far more than you currently do working full-time.

Now, let's say you wanted to double that number. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day there are millions of opportunities for creating value. This includes selling products, ideas, services, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Helping others achieve theirs is the real goal.

If you want to get ahead, then focus on creating value. My free guide, How To Create Value and Get Paid For It, will help you get started.

How can a novice earn passive income as a contractor?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You may even have a few ideas already. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

Finding a job that matches your interests and skills is the best way to make money online.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

Writing is your passion, so you might like to review products. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. This will ensure that you stick with it for the long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main approaches to this. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In both cases, once you have set your rates you need to make them known. It can be shared on social media or by emailing your contacts, posting flyers, and many other things.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

e professional - always act like a professional when doing anything related to marketing. It is impossible to predict who might be reading your content.

-

Be knowledgeable about the topic you are discussing. A fake expert is not a good idea.

-

Do not spam. If someone asks for information, avoid sending emails to everyone in your email list. Do not send out a recommendation if someone asks.

-

Make sure you have a reliable email provider. Yahoo Mail and Gmail are both free and easy-to-use.

-

You can monitor your results by tracking how many people open your emails, click on links and sign up to your mailing lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Get feedback - ask friends and family whether they would be interested in your services, and get their honest feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

You must continue learning and remain relevant in marketing.

What's the best way to make fast money from a side-hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. It is important to establish a good reputation online as well offline.

Helping others solve their problems is a great way to build a name. Ask yourself how you can be of value to your community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many online ways to make money, but they are often very competitive.

You will see two main side hustles if you pay attention. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its advantages and disadvantages. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow your business without worrying about shipping products or providing services. However, it can take longer to be recognized as an expert in your area.

You must learn to identify the right clients in order to be successful at each option. This can take some trial and error. But in the long run, it pays off big time.

Why is personal finance so important?

For anyone to be successful in life, financial management is essential. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

So why do we put off saving money? Is there anything better to spend our energy and time on?

Yes and no. Yes, most people feel guilty saving money. You can't, as the more money that you earn, you have more investment opportunities.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Financial success requires you to manage your emotions. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Unrealistic expectations may also be a factor in how much you will end up with. This is because your financial management skills are not up to par.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What is the easiest way to make passive income?

There are many different ways to make online money. But most of them require more time and effort than you might have. How do you make extra cash easy?

Finding something you love is the key to success, be it writing, selling, marketing or designing. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

Another option is to start a blog. It's important to choose a topic you are passionate about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

While there are many methods to make money online there are some that are more effective than others. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is known content marketing.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to Make Money Even While You Sleep

Online success requires that you learn to sleep well while awake. This means learning to do more than wait for someone to click on your link or buy your product. Make money while you're sleeping.

You will need to develop an automated system that generates income without having to touch a single button. Automating is the key to success.

It would be a great help to become an expert in building software systems that automate tasks. So you can concentrate on making money while sleeping. You can automate your job.

This is the best way to identify these opportunities. Start by listing all of your daily problems. Then ask yourself if there is any way that you could automate them.

Once you've done this, it's likely that you'll realize there are many passive income streams. Now you need to choose which is most profitable.

A website builder, for instance, could be developed by a webmaster to automate the creation of websites. Perhaps you are a graphic artist and could use templates to automate the production logos.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds of options.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is the key for financial freedom.