If you are in extreme debt, consolidation may be an option. StepChange, Payplan, and National Debtline offer free debt management plans. These plans can help you manage your short-term debt, but if you're in severe debt, you might need to turn to insolvency procedures. These include a Debt Relief Order, or an Individual Voluntary Arrangement. This can help you avoid collection agencies taking legal action against yourself for a set period.

Interest rates for debt consolidation loans

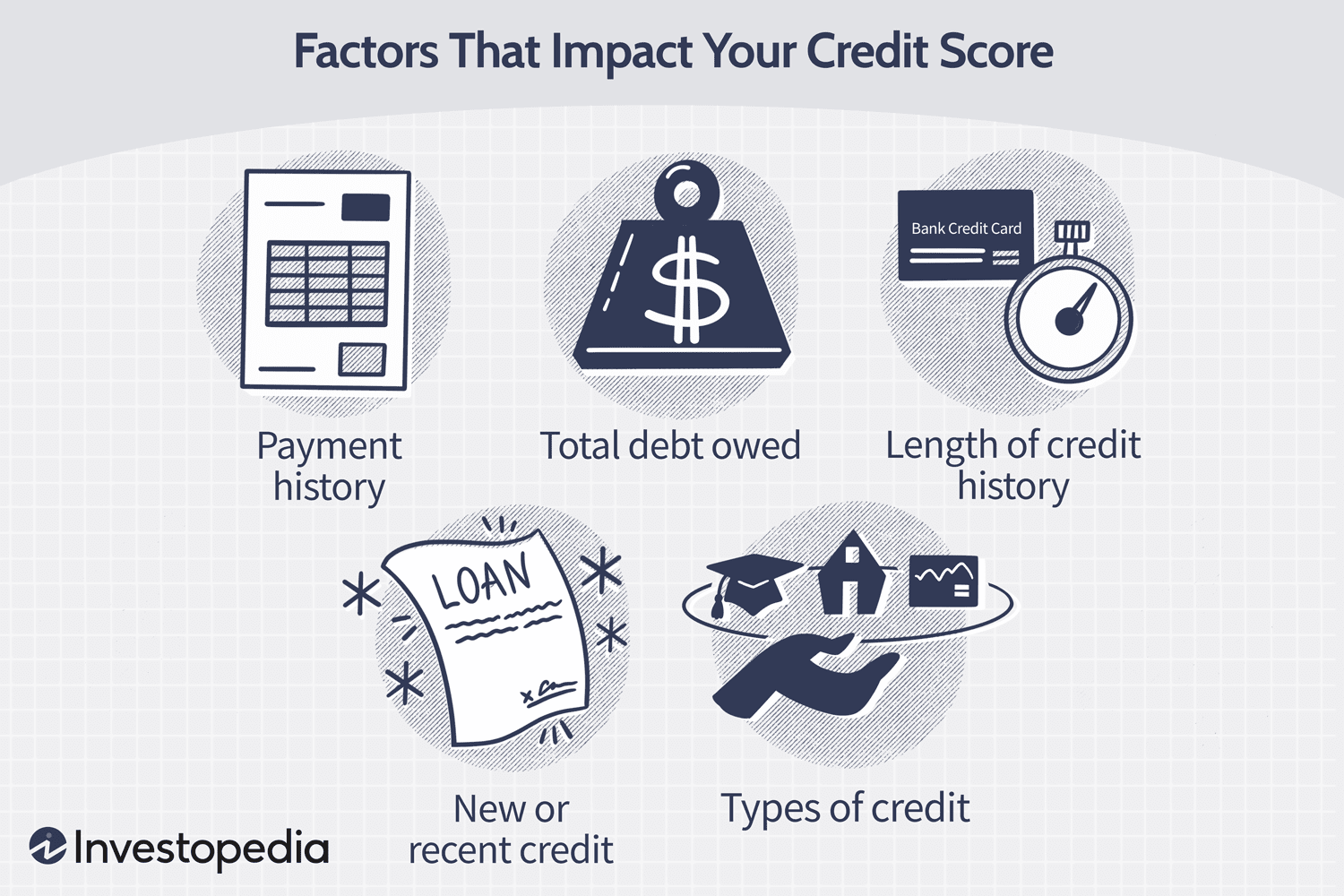

You can lower your interest expenses with debt consolidation loans. All you have to do is make one payment every month. You can consolidate multiple debts into a single loan and pay off the remainder with the savings. This strategy will allow you to get rid of your debts faster, as well as improve your credit score. Consolidation loans come with fees.

There are many variables in the interest rates on debt consolidation loans. They can go as low as 5% and as high as 36%. If you have a good credit score, you will be able to get a low interest rate. However, it is important that you shop around for the best rate.

There are fees associated with debt consolidation loans

Debt consolidation loans typically charge a few fees. These fees are dependent on the loan type but are usually low. For example, a home equity loan may have a 2% to 5% origination fee. Balance transfers usually have a 3%-5% transfer fee.

Consolidating all of your credit cards and debts can help you obtain a lower monthly interest rate. However, if you have bad credit, you will probably be unable to obtain a loan with a lower interest rate.

Time it takes to apply for a loan

Credit score is an essential consideration when applying for debt consolidation loans. A good credit score will increase your chances of receiving a loan at the best terms. Experian gives you access to your credit score free of charge. The higher your credit score, the lower your interest rate.

You need to apply to multiple lenders to get the best rate for a consolidation loan. The more lenders you talk to, the better your chances of getting approved. Rate-shopping websites allow you to compare lenders. However, it is possible to also get in touch with individual lenders. Some lenders will perform soft credit checks.

How to decide if consolidating your debts is a good idea

Whether or not debt consolidation is a good idea for you depends on several factors. It all depends on your financial situation, what type of debt, and your priorities. Consider consolidating your debt if you have difficulty paying off existing debts or have a high interest.

Consolidating debts can help you lower your monthly payments, and make it easier to manage your finances. However, it's crucial to do your research and compare several different loan offers. While you'll want to choose the lowest interest rate, it's also important to compare repayment periods. The shorter the repayment term, the greater the savings.

FAQ

Why is personal financing important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

Why do we delay saving money? Is there anything better to spend our energy and time on?

Both yes and no. Yes because most people feel guilty about saving money. Yes, but the more you make, the more you can invest.

Focusing on the big picture will help you justify spending your money.

It is important to learn how to control your emotions if you want to become financially successful. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

It is possible to have unrealistic expectations of how much you will accumulate. This could be because you don't know how your finances should be managed.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

Which passive income is easiest?

There are many options for making money online. But most of them require more time and effort than you might have. How can you make it easy for yourself to make extra money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is known as affiliate marketing and you can find many resources to help get started. Here's a collection of 101 affiliate marketing tips & resources.

You could also consider starting a blog as another form of passive income. You'll need to choose a topic that you are passionate about teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many ways to make money online, but the best ones are usually the simplest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

How can a beginner make passive income?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You might have some ideas. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

Finding a job that matches your interests and skills is the best way to make money online.

If you are passionate about creating apps and websites, you can find many opportunities to generate revenue while you're sleeping.

Writing is your passion, so you might like to review products. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what focus you choose, be sure to find something you like. If you enjoy it, you will stick with the decision for the long-term.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

There are two main options. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In either case, once you've set your rates, you'll need to promote them. This means sharing them on social media, emailing your list, posting flyers, etc.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

e professional - always act like a professional when doing anything related to marketing. You never know who will review your content.

-

Know your subject matter before you speak. A fake expert is not a good idea.

-

Do not spam. If someone asks for information, avoid sending emails to everyone in your email list. Send a recommendation directly to anyone who asks.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

Measure your ROI - measure the number of leads generated by each campaign, and see which campaigns bring in the most conversions.

-

Get feedback - ask friends and family whether they would be interested in your services, and get their honest feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

You must continue learning and remain relevant in marketing.

Is there a way to make quick money with a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. It's important to have a strong online reputation.

Helping others solve their problems is a great way to build a name. Ask yourself how you can be of value to your community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

However, if you look closely you'll see two major side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its advantages and disadvantages. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. It takes more time to become an expert in your field.

To be successful in either field, you must know how to identify the right customers. It will take some trial-and-error. It pays off in the end.

How does a rich person make passive income?

There are two methods to make money online. One is to create great products/services that people love. This is called "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is what we call "passive" or passive income.

Let's say that you own an app business. Your job is developing apps. But instead of selling them directly to users, you decide to give them away for free. Because you don't rely on paying customers, this is a great business model. Instead, you rely upon advertising revenue.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is the way that most internet entrepreneurs are able to make a living. They are more focused on providing value than creating stuff.

How to make passive income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

This means that you must understand their wants and needs. You must learn how to connect with people and sell to them.

The next step is how to convert leads and sales. To keep clients happy, you must be proficient in customer service.

Although you might not know it, every product and service has a customer. And if you know who that buyer is, you can design your entire business around serving him/her.

A lot of work is required to become a millionaire. It takes even more work to become a billionaire. Why? You must first become a thousandaire in order to be a millionaire.

Then you must become a millionaire. You can also become a billionaire. The same is true for becoming billionaire.

How does one become a billionaire, you ask? You must first be a millionaire. All you need to do to achieve this is to start making money.

However, before you can earn money, you need to get started. Let's now talk about how you can get started.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to make money while you're asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means more than waiting for someone to click on the link or buy your product. Making money at night is essential.

This requires you to create an automated system that makes money without you having to lift a finger. You must learn the art of automation to do this.

You would benefit from becoming an expert at developing software systems that perform tasks automatically. So you can concentrate on making money while sleeping. You can even automate the tasks you do.

It is best to keep a running list of the problems you face each day to help you find these opportunities. Next, ask yourself if there are any ways you could automate them.

Once you have done this, you will likely realize that there are many ways you can generate passive income. Now you need to choose which is most profitable.

For example, if you are a webmaster, perhaps you could develop a website builder that automates the creation of websites. Perhaps you are a graphic artist and could use templates to automate the production logos.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds of possibilities.

Automation is possible as long your creative ideas solve a problem. Automation is the key for financial freedom.