A low-interest loan is the best choice when searching for a debt consolidation loan. Look for loans with fixed rates of repayment if you can. Avoid scams. You can use these tips to find the best loan consolidation for you.

Get a consolidation loan for low-interest debt

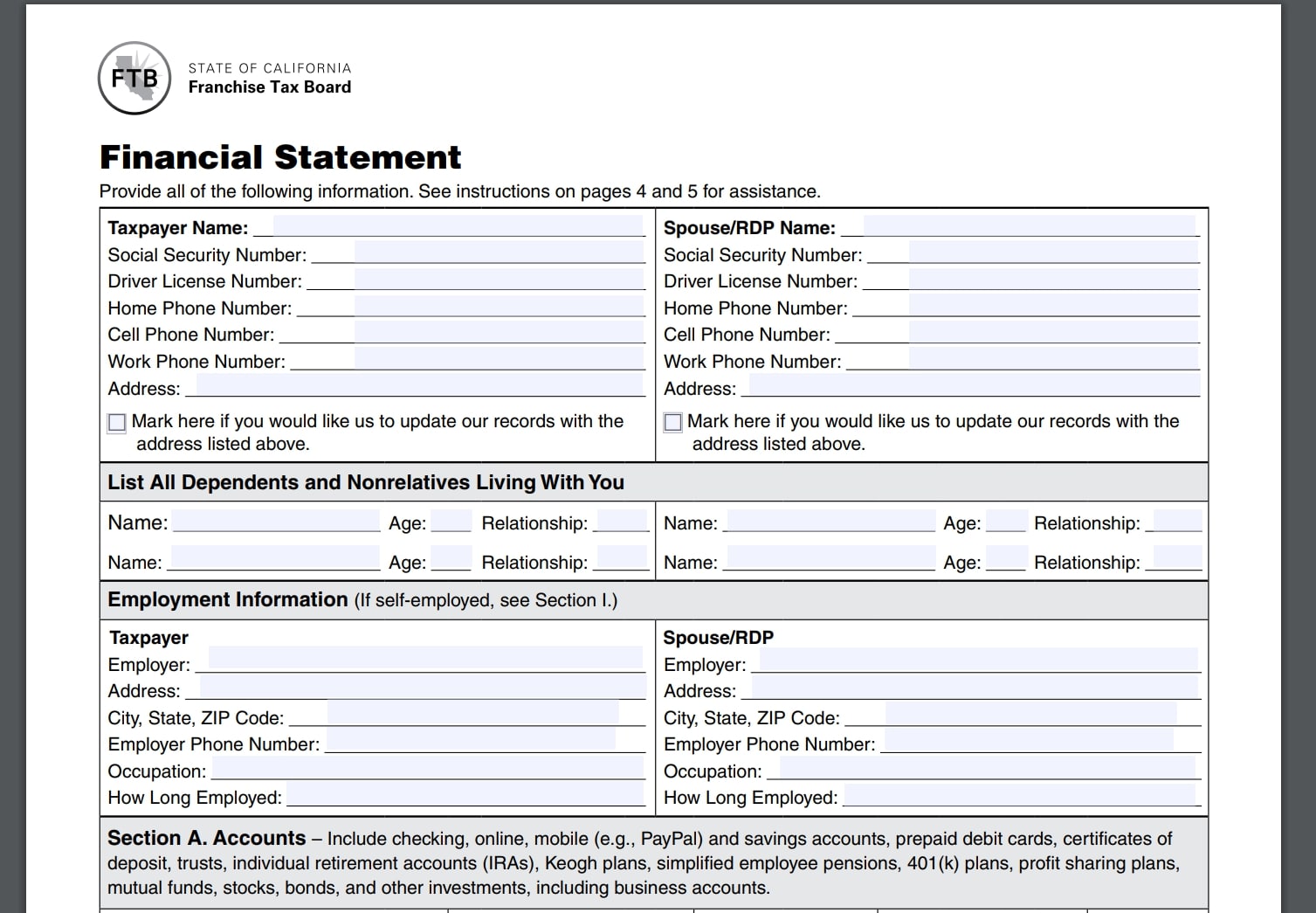

Before you apply to consolidate your debt, you should evaluate your financial situation. Lenders will evaluate your income, credit score and financial ability to determine if monthly payments can be afforded. Make sure your credit score does not exceed the cutoff. This will make it easier for you to qualify.

Consolidating debt can help you to get out of financial difficulty and pay off credit cards. These loans are not right for everyone. Bad credit will need to pay higher interest rates. Consider a home equity loan for low-interest loans.

Calculate loan amount

Before you decide to take out a consolidation loan for your debt, it is important that you know how much money you are able to afford. Your income, as well as other factors such your balances and existing debts, will affect the amount of your loan. A debt consolidation calculator can help you choose the right consolidation option. The calculator will allow for you to enter your debt balances, monthly payment and interest rate. After entering this information, it will calculate your monthly total payment.

Once you know how much you can afford to borrow, you can decide which repayment plan is right for you. With the aim to help you repay your debts sooner, a debt consolidation loans will combine several loans. This option can save you money in long-term.

Consider fixed-rate payments

There are many lenders that offer personal loans for consolidation. A loan with favorable terms and repayment terms to suit your needs and budget is possible. First Midwest Bank and Discover offer loans with fixed rates of less than 6.6% APR. These lenders don't charge origination fees. Also, look for a loan that suits your credit score. Some lenders are experts in loans for people with poor credit.

The best debt consolidation loan will have a lower APR than the total of your current debts. Because a lower interest rate is better for you, it will make it easier to afford the loan and allow you to repay it over time. A loan should have a reasonable term repayment and no or low fees. These are the most important features to consider when choosing a loan consolidation loan. Most lenders offer adjustable rate and fixed rate loans. The credit score of your borrower, income level, debt-toincome ratio, and other factors will affect the interest rate.

Avoid falling for scams

Checking their background is one of the first steps to finding the right debt consolidation firm for you. Look for a Better Business Bureau rating, and make sure their website has a lock symbol. It should also provide a physical location. Make sure you don't fall for common scams.

A lead generation website is one sign that a scammer is operating. These sites often pose as legitimate companies, but they are merely referral services. This doesn't necessarily make them scams. However, it is important to ensure that you work with a legitimate lender and not a middleman who hasn't been vetted. Be wary of lead generation websites that claim to be affiliated or Native American tribes. These organizations might have a license or agreement with Indian Tribes.

FAQ

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. If you do it well, the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. When you were little, you took your mommy's breastmilk and it gave you life. When you learned how to walk, you gave yourself a better place to live.

Giving value to your friends and family will help you make more. Actually, the more that you give, the greater the rewards.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In reality, Earth has nearly 7 Billion people. This means that every person creates a tremendous amount of value each day. Even if you created $1 worth of value an hour, that's $7 million a year.

If you could find ten more ways to make someone's week better, that's $700,000. Think about that - you would be earning far more than you currently do working full-time.

Let's say that you wanted double that amount. Let's say that you found 20 ways each month to add $200 to someone else's life. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every day there are millions of opportunities for creating value. This includes selling ideas, products, or information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. The ultimate goal is to assist others in achieving theirs.

To get ahead, you must create value. Use my guide How to create value and get paid for it.

How much debt is too much?

There is no such thing as too much cash. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

The key here is to pay off debts as quickly as possible. This includes credit card bills, student loans, car payments, etc. After these debts are paid, you will have more money to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. You may lose your money if the stock markets fall. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. That would amount to $500 over five years. Over six years, that would amount to $1,000. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. This is quite remarkable. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, your net worth would be more than $57,000.

It's crucial to learn how you can manage your finances effectively. A poor financial management system can lead to you spending more than you intended.

Why is personal financial planning important?

A key skill to any success is personal financial management. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why do we put off saving money? Is it not better to use our time or energy on something else?

Both yes and no. Yes, because most people feel guilty when they save money. You can't, as the more money that you earn, you have more investment opportunities.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This could be because you don't know how your finances should be managed.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How do you build passive income streams?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

This means that you must understand their wants and needs. This requires you to be able connect with people and make sales to them.

You must then figure out how you can convert leads into customers. To keep clients happy, you must be proficient in customer service.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

To become a millionaire it takes a lot. To become a billionaire, it takes more effort. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Finally, you can become a millionaire. Finally, you can become a multi-billionaire. The same applies to becoming a millionaire.

How do you become a billionaire. Well, it starts with being a thousandaire. To achieve this, all you have to do is start earning money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

What is the difference between passive and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires hard work and effort.

You create value for another person and earn active income. You earn money when you offer a product or service that someone needs. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great because it allows you to focus on more important things while still making money. However, most people don't like working for themselves. So they choose to invest time and energy into earning passive income.

Passive income doesn't last forever, which is the problem. You might run out of money if you don't generate passive income in the right time.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, So it's best to start now. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are 3 types of passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

How do wealthy people earn passive income through investing?

If you're trying to create money online, there are two ways to go about it. One way is to produce great products (or services) for which people love and pay. This is what we call "earning money".

You can also find ways to add value to others, without having to spend your time creating products. This is called "passive" income.

Let's suppose you have an app company. Your job is to develop apps. But instead of selling them directly to users, you decide to give them away for free. Because you don't rely on paying customers, this is a great business model. Instead, you rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how successful internet entrepreneurs today make their money. Instead of making things, they focus on creating value for others.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

Get passive income ideas to increase cash flow

There are ways to make money online without having to do any hard work. There are many ways to earn passive income online.

Automating your business could be a benefit to an already existing company. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

The more automated your company becomes, the more efficient you will see it become. This allows you more time to grow your business, rather than run it.

Outsourcing is a great way of automating tasks. Outsourcing lets you focus on the most important aspects of your business. By outsourcing a task you effectively delegate it to another party.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

A side hustle is another option. Another way to make extra money is to use your talents and create a product that can be sold online.

Write articles, for example. There are plenty of sites where you can publish your articles. These sites pay per article and allow you to make extra cash monthly.

You can also consider creating videos. Many platforms enable you to upload videos directly onto YouTube or Vimeo. These videos will bring traffic to your site and social media pages.

You can also invest in stocks or shares to make more money. Stocks and shares are similar to real estate investments. However, instead of paying rent, you are paid dividends.

You receive shares as part of your dividend, when you buy shares. The amount you get depends on how many shares you purchase.

You can sell shares later and reinvest the profits into more shares. You will keep receiving dividends for as long as you live.