Consolidating and refinancing the student loan debt can save you money. But before you decide, it's crucial to know the benefits of each type and how they operate. This will enable you to determine whether refinancing your loan or consolidating it is the right choice for you.

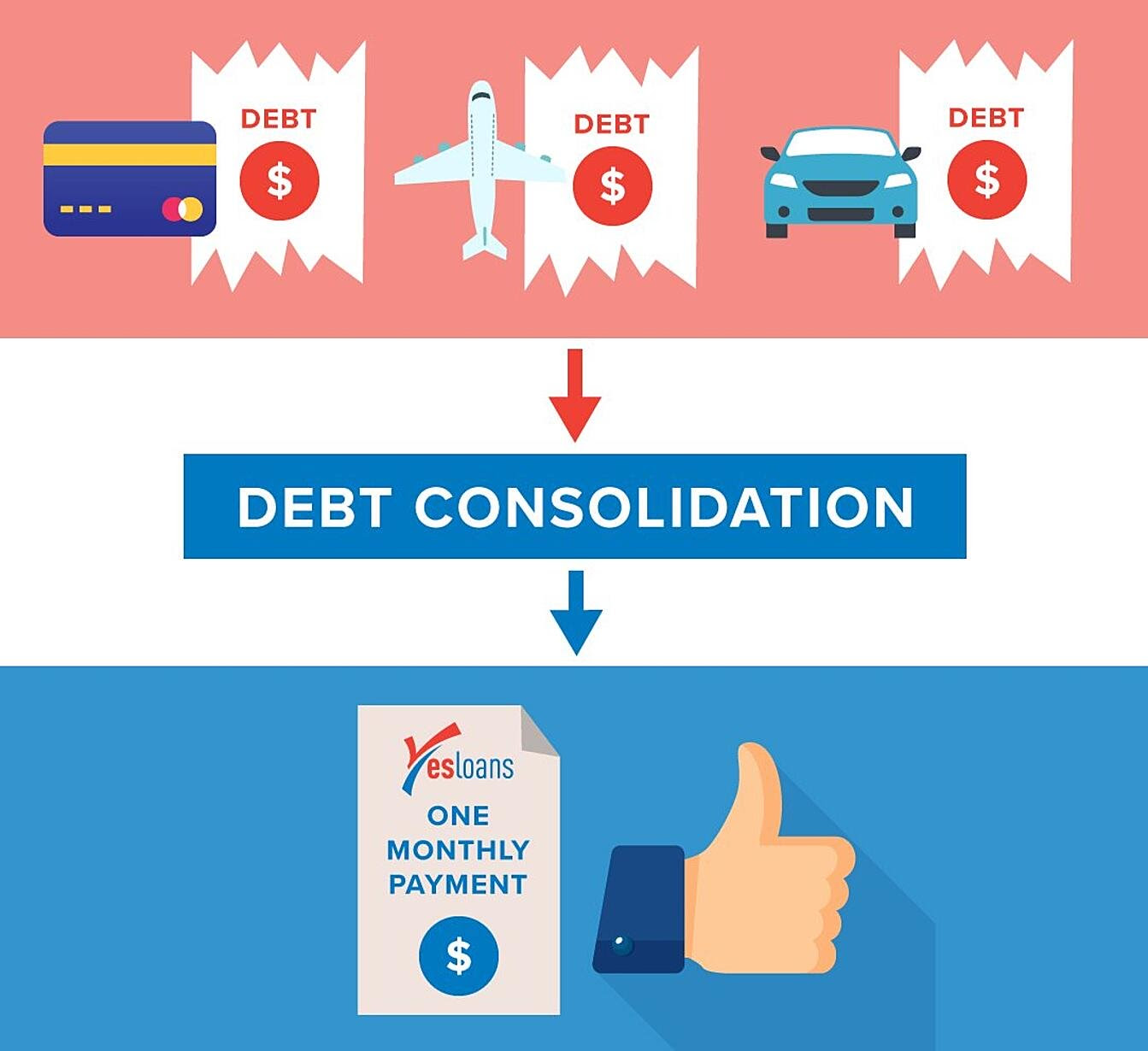

The consolidation of multiple student loan amounts into a single loan is done by combining them, often with a lower rate. This will decrease your total monthly payment, and shorten the amount of time you need to pay off all your debt.

The process can be complicated, so be sure to take your time and read the fine print. Purefy’s Compare rate tool can help you compare rates between several lenders.

Refinancing is the process of transferring your existing student loans to a new lender and changing the terms of your loans. Refinancing can be a good way to get a better rate of interest or restructure the payments. But it could also damage your credit score.

If you refinance your mortgage, it's possible to lose some federal protections. This includes more flexible plans for repayment or income-driven plans. Consider refinancing only if you do not participate in any of the above programs and will not need them in future.

You should consider refinancing if you have federal student loans, and you want to save money on your interest rate or reduce your payments. To get the best interest rate, you need to find a program that fits with your budget and financial situation.

A refinance typically requires more documentation and is a little more complicated than consolidating. This means that you will have to fill out the application form, submit your promissory statement and confirm your income.

Additionally, you will need to choose your plan and loan servicer. You can choose from several options such as FedLoan.

You consolidate your student loan into a new loan with a higher interest rate. The term is also longer. The longer your term is, the less you pay each month, but over the entire loan's life, interest costs will increase.

Direct Consolidation loan is a federal option for consolidating federal student loans. This process is completely free and you can do it online using the U.S. Department of Education system.

You can apply either online or by post to consolidate your federal loan. Personal information such as your address and driver's number will be needed, along with two references whom you've known for three years.

List your education loans along with any other debts before you fill out the application. Select the type student loan (e.g. undergraduate, graduate or professionals) and repayment plan that you would like to use. You can select a loan servicer, and you can request a grace-period before starting to make payments.

FAQ

How do wealthy people earn passive income through investing?

There are two options for making money online. Another way is to make great products (or service) that people love. This is called "earning" money.

You can also find ways to add value to others, without having to spend your time creating products. This is "passive" income.

Let's say you own an app company. Your job is development apps. But instead of selling them directly to users, you decide to give them away for free. It's a great model, as it doesn't depend on users paying. Instead, your advertising revenue will be your main source.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how most successful internet entrepreneurs earn money today. They focus on providing value to others, rather than making stuff.

What is personal financial planning?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You no longer have to worry about paying rent or utilities every month.

And learning how to manage your money doesn't just help you get ahead. It makes you happier overall. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finance anyway? Everyone does! Personal finance is a very popular topic today. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

People use their smartphones today to manage their finances, compare prices and build wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. It leaves just two hours each day to do everything else important.

When you master personal finance, you'll be able to take advantage of that time.

How to create a passive income stream

To earn consistent earnings from the same source, it is important to understand why people make purchases.

Understanding their needs and wants is key. This requires you to be able connect with people and make sales to them.

The next step is to learn how to convert leads in to sales. To retain happy customers, you need to be able to provide excellent customer service.

This is something you may not realize, but every product or service needs a buyer. You can even design your entire business around that buyer if you know what they are.

It takes a lot of work to become a millionaire. It takes even more work to become a billionaire. Why? Why?

Then, you will need to become millionaire. And finally, you have to become a billionaire. You can also become a billionaire.

How can someone become a billionaire. It starts by being a millionaire. To achieve this, all you have to do is start earning money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

What is the limit of debt?

There is no such thing as too much cash. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. When you run out of money, reduce your spending.

But how much is too much? There is no universal number. However, the rule of thumb is that you should live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

Paying off your debts quickly is the key. This includes student loans, credit cards, car payments, and student loans. Once these are paid off, you'll still have some money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if the money is put into savings accounts, it will compound over time.

Consider, for example: $100 per week is a savings goal. This would add up over five years to $500. You'd have $1,000 saved by the end of six year. You would have $3,000 in your bank account within eight years. When you turn ten, you will have almost $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. That's pretty impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. You'd have more than $57,000 instead of $40,000

This is why it is so important to understand how to properly manage your finances. Otherwise, you might wind up with far more money than you planned.

What side hustles make the most profit?

Side hustles are income streams that add to your primary source of income.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types of side hustles: passive and active. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. A fitness business is a great option if you enjoy working out. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles can be found anywhere. You can find side hustles anywhere.

Why not start your own graphic design company? You might also have writing skills, so why not start your own ghostwriting business?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. If the opportunity arises, this will allow you to be prepared to seize it.

Side hustles aren’t about making more money. Side hustles can be about creating wealth or freedom.

There are many ways to make money today so there's no reason not to start one.

What's the best way to make fast money from a side-hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

Helping people solve problems is the best way build a reputation. You need to think about how you can add value to your community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many opportunities to make money online. But they can be very competitive.

If you are careful, there are two main side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

There are pros and cons to each approach. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting helps you grow your company without worrying about shipping goods or providing service. However, it can take longer to be recognized as an expert in your area.

In order to succeed at either option, you need to learn how to identify the right clientele. This takes some trial and errors. But, in the end, it pays big.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

How to make money even if you are asleep

If you are going to succeed online, you must learn how to sleep while you are awake. This means that you must be able to do more than simply wait for someone click on your link to buy your product. Making money at night is essential.

You will need to develop an automated system that generates income without having to touch a single button. Automation is a skill that must be learned.

You would benefit from becoming an expert at developing software systems that perform tasks automatically. That way, you can focus on making money while you sleep. You can even automate yourself out of a job.

This is the best way to identify these opportunities. Start by listing all of your daily problems. Next, ask yourself if there are any ways you could automate them.

Once you've done this, it's likely that you'll realize there are many passive income streams. You now need to decide which one would be the most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Perhaps you are a graphic artist and could use templates to automate the production logos.

A software program could be created if you are an entrepreneur to allow you to manage multiple customers simultaneously. There are many possibilities.

Automation is possible as long your creative ideas solve a problem. Automation is the key to financial freedom.